Ahold Delhaize Expects to List Bol.com Retail Platform in 2nd Half 2022 -- Update

15 November 2021 - 11:11AM

Dow Jones News

By Jaime Llinares Taboada

Koninklijke Ahold Delhaize NV said Monday that it will explore

an initial public offering of its subsidiary Bol.com.

The IPO is expected to happen in the second half of 2022,

subject to factors including market conditions, Ahold Delhaize

said. It will involve a listing of a limited shareholding on

Euronext Amsterdam, and Ahold Delhaize will retain significant

control in the business.

The Dutch grocer said listing the retail platform would fuel its

"tremendous growth potential" and provide further funding for the

parent company.

Bol.com is expected to deliver net consumer online sales of 5.5

billion euros ($6.29 billion) and earnings before interest, taxes,

depreciation and amortization of EUR150 million-EUR170 million in

2021. Ahold Delhaize wants to double those figures by 2025.

Ahold Delhaize also said it will aim to grow group sales by

EUR10 billion by 2025, and will launch a EUR1 billion share-buyback

program at the beginning of 2022.

As part of its investor day presentation, the company provided a

set of targets for 2025. It will seek to maintain industry-leading

margins while doubling online sales and delivering

high-single-digit annual underlying earnings-per-share growth.

In the shorter term, Ahold Delhaize also plans to buy back EUR1

billion of shares in 2022. The company expects 2022 sales to grow

despite macroeconomic headwinds, with an operating margin of at

least 4.0%.

Write to Jaime Llinares Taboada at jaime.llinares@wsj.com;

@JaimeLlinaresT

(END) Dow Jones Newswires

November 15, 2021 04:56 ET (09:56 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

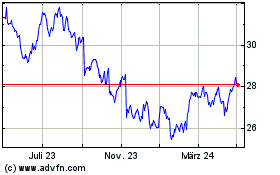

Koninklijke Ahold Delhai... (EU:AD)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

Koninklijke Ahold Delhai... (EU:AD)

Historical Stock Chart

Von Apr 2023 bis Apr 2024