USDC Is In Trouble, But It Won’t Go To Zero Like UST Did – Here’s Why

11 März 2023 - 12:06PM

NEWSBTC

USDC, the stablecoin tracing the USD, is under immense pressure as

users rush to convert to other assets, including BUSD by Paxos and

USDT by Tether Holdings. USDC Has De-pegged As USDC’s market cap

rapidly shrinks, primarily because of mass exits, there has been a

de-peg. The stablecoin is trading at $0.90 to the USD at the time

of writing on March 11. However, amidst this fear, USDC won’t

likely crash to zero like UST, the algorithmic stablecoin by Terra,

did. Related Reading: Bitcoin Rally Fueled By USD Coin (USDC)

Rotating Into BTC: Santiment The collapse of UST was attributed to

its structure and backing by other digital assets, including

Bitcoin and LUNA. Since it depended on algorithms to track

the value of the USD and always ensure parity, any pressure on any

underlying coins, Bitcoin or LUNA, led to intense selling pressure,

causing a de-peg. The UST de-peg triggered a ripple effect

that eventually saw the crypto market drop below $30k, causing

massive liquidation and pain for affected holders. What’s on the

table currently is USDC by Circle. Although USDC is at $0.90,

further weighing negatively on cryptocurrency prices, it is

improbable that the USDC will drop to $0. As an illustration,

the token has a circulating supply of $40.9 billion as of March 11.

Each USDC token, it should be noted, is backed 1:1 with cash, and

redemption means every backing cash or cash equivalent from Circle

must be sold and disbursed to the client. Expecting Normalcy To

Resume On Monday? Circle has said it has enough reserves despite

$3.3 billion out of the total $40 billion held at Silicon Valley

Bank (SVB). 1/ Following the confirmation at the end of today

that the wires initiated on Thursday to remove balances were not

yet processed, $3.3 billion of the ~$40 billion of USDC reserves

remain at SVB. — Circle (@circle) March 11, 2023 Because SVB was

FDIC insured, there will be a 94% payout, meaning even if there is

a loss of approximately $198 million, it won’t be a big dent for

Circle to warrant fears and conversions to other stablecoins. The

loss will likely be covered by interest payments from treasuries,

where most of Circle’s assets are held in. Several other factors

worsen the current stablecoin’s preview, even contributing to the

de-peg. The decision by Coinbase to pause USDC to fiat

conversions over the weekend until Monday is stoking fear. Related

Reading: Binance To Raise USDT, USDC, and TUSD Transaction Fees On

Tron By 160% We are temporarily pausing USDC: USD conversions over

the weekend while banks are closed. During periods of heightened

activity, conversions rely on USD transfers from the banks that

clear during normal banking hours. When banks open on Monday, we

plan to re-commence conversions. From next week Monday, the peg

will likely be restored as arbitrageurs flow back in. Feature Image

From Canva, Chart From TradingView

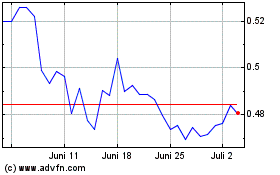

Ripple (COIN:XRPUSD)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

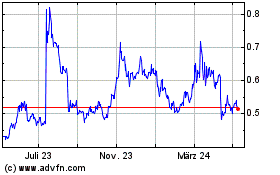

Ripple (COIN:XRPUSD)

Historical Stock Chart

Von Apr 2023 bis Apr 2024