Crypto Market Tides Forecast Profits, Report Shows

07 Februar 2023 - 6:00PM

NEWSBTC

After the unreeled crypto winter, the market continues to show

signs of revival after the debacle of institutions and exchanges

filing for bankruptcy in late 2022. Following a month of upward

price action fueled by investors betting on crypto in January, the

market sentiment may turn its tide and move into the green land.

Related Reading: This Bitcoin On-Chain Metric Is At A Historical

Resistance, Will BTC Decline? According to a report from on-chain

analytics firm Glassnode, Bitcoin (BTC) is consolidating above the

on-chain cost basis of several cohorts. This puts the average BTC

holder into a regime of unrealized gains and suggests a potential

turning of the macro market tides, the firm believes. The

Shift Of Crypto Market Tides Is Underway Using Glassnode’s

on-chain analysis, the crypto market can see an explosion of

profit-taking after October 2020 in response to monetary policy.

According to Glassnode, this can decrease dramatically from the

peak in January 2021, detoxing over the following two years and

bringing the market back to 2020 levels. Glassnode’s analysis

suggests that the losses realized by the market over this period

began to widen after January 2021, reaching an initial peak in the

May 2021 sell-off after digital assets, equities, and bonds

struggled under tightening monetary conditions. Following the

collapse in price action after reaching an all-time high (ATH) in

November 2021, the market is witnessing the first sustained period

of profitability since the liquidity exit in April 2022, suggesting

the first signs of a change in the profitability regime.

Glassnode’s Reserve Risk metric can be used to contextualize the

behavior of the HODLer class. This cyclical oscillator quantifies

the balance between the aggregate incentive to sell and the actual

spending of long-dormant coins. Higher values indicate that price

and HODLer spending is increasing, while lower values indicate that

price and HODLer spending are decreasing. As this oscillator

continues to move toward its equilibrium position, it may indicate

that the opportunity cost of HODLing is decreasing while the

incentive to sell is increasing. Previous breakouts above the

equilibrium position have marked a transition from a regime of

HODLing to one of increasing profit realization and a rotation of

capital from bear market accumulators back to newer investors and

speculators, according to the Glassnode analysis. From a

Crypto-Winter To a Thaw After long months of the bear market and

its aftermath, which has frozen large cryptocurrencies, Glassnode

says there are signs of a “full detox,” and a cyclical transition

may be underway. For Glassnode, the market appears to be in

transition, moving from the late stages of a bear market to the

beginning of a new cycle. Past cycles should serve as a guide, but

for Glassnode, the road ahead remains challenging, with 2015 and

2019 as critical examples. In short, Glassnode concludes that these

transition periods have historically been characterized by extended

sideways price action in the market, with local volatility moves in

both directions. Bitcoin continues to hold the line of support at

$22,600, with sideways price action in recent days. BTC is

currently trading at $22,950 with a gain of 0.9% in the last 24

hours and a slight recovery of 0.6% in the previous seven days.

Related Reading: XRP Price Still Looks Bearish, But This Ripple

Visa Rumor Might Change It With a market cap of $443 billion,

Bitcoin has the signs and the favorable wind to narrow the gap

between its ATH of $69,000 and the current price. Bitcoin is

currently consolidating around the $23,000 level and is aiming to

find new yearly highs and remain in the green land for the rest of

the year. Featured image from Unsplash, charts from Glassnode, and

Tradingview.

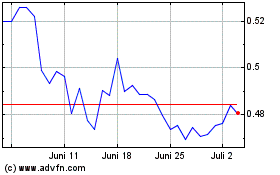

Ripple (COIN:XRPUSD)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

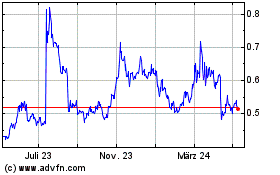

Ripple (COIN:XRPUSD)

Historical Stock Chart

Von Apr 2023 bis Apr 2024