UK Think Tank Opposes Bank Of England’s CBDCs

15 Februar 2023 - 2:30PM

NEWSBTC

The UK Tax Reform Council, a non-profit organization, recently

opposed the Bank of England’s move to create CBDCs. According to

the council, this move will not profit the masses, as the

government will get more rights over individuals’ finances. UK Tax

Reform Council Kicks Against CBDCs The UK think tank has launched a

campaign against central bank digital currencies of England that

use surveillance measures. The United Kingdom Tax Reform Council

has argued that CBDCs with intrusive surveillance capabilities

could trespass on individual privacy and promote financial

vulnerability. Related Reading: Bitcoin NUPL Retests Key Support,

Will BTC Rebound? The campaign comes at a time when several central

banks worldwide are exploring the potential benefits of CBDCs –

digital versions of fiat currencies. However, the organization has

raised concerns about CBDCs that collect user data or employ

blockchain-based technologies that could track and store every

transaction. As per the council, which includes monetary economist

and cofounder of Fiscal Studies, John Chown, such a system could be

vulnerable to hacks, data breaches, and abuse by government

agencies or third-party entities. Additionally, it argues that

CBDCs with surveillance capabilities could enable governments to

monitor individuals’ financial behavior, giving them more authority

over matters regarding finance. Bitcoin, A Rival Of CBDCs? The

United Kingdom Tax Reform Council has argued that Bitcoin (BTC)

offers the same advantages as a central bank digital currency

(CBDC). These include reduced costs for businesses and consumers,

increased security, and greater privacy. Per the council,

Bitcoin already provides the same benefits as the CBDCs, such as

improved financial inclusion, faster payment processing, and

reduced transaction costs. So, the Tax Reform Council has

encouraged the government to consider alternative CBDCs and explore

other digital currencies such as Bitcoin. The campaign has gained

traction among experts and policymakers, who share similar concerns

about CBDCs with surveillance measures. However, supporters of

CBDCs argue that they could provide a more efficient, secure, and

accessible payment system, particularly for the unbanked

population. The Digital Currency Claims Currently, 114 countries

are exploring CBDCs, says the Atlantic Council. England’s bank

CBDCs claim to provide several benefits to global financial

institutions. One of the main motivations it claims to offer is to

increase financial inclusion. Digital currencies could

provide access to financial services for individuals who do not

have a bank account. Additionally, digital currencies could reduce

the costs and inefficiencies associated with physical cash by

eliminating the need for printing, transportation, and storage.

Related Reading: Bitcoin Large Transactions Explode, Whales Buying

The Dip? Moreover, digital currencies could improve payment system

efficiency and security by enabling real-time payments, reducing

settlement times, and increasing transparency. They could also

enhance monetary policy by allowing for greater control over the

money supply and better monitoring of economic activity.

Furthermore, central banks may be exploring digital currencies to

mitigate the potential risks from private cryptocurrencies by

providing a safe, reliable, and regulated alternative. But as the

debate over CBDCs continues, it remains to be seen whether central

banks will heed the think tank’s call for privacy-focused CBDCs or

opt for the more surveillance-heavy model. Featured image from

Pixabay, charts from TradingView.com

(COIN:XCNNUSD)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

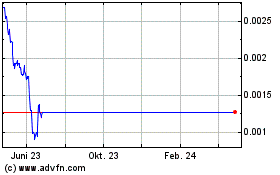

(COIN:XCNNUSD)

Historical Stock Chart

Von Apr 2023 bis Apr 2024

Echtzeit-Nachrichten über (Cryptocurrency): 0 Nachrichtenartikel

Weitere Chain News-Artikel