How Does Current Bitcoin Rally Compare With Historical Ones?

22 Mai 2023 - 7:30PM

NEWSBTC

Here’s how the current Bitcoin rally stacks up against the previous

ones in terms of the drawdowns it has experienced so far. The

Current Bitcoin Rally Has Seen A Peak Drawdown Of -18.6% So Far In

a recent tweet, the on-chain analytics firm Glassnode compared the

latest Bitcoin rally with the ones seen throughout the entire

history of the cryptocurrency. Generally, rallies are compared

using metrics like the percentage price uplifts recorded during

them or the amount of time that they lasted (which may be measured

in terms of the blocks produced, as is done when looking at cycles

in terms of halvings). Here, however, Glassnode has taken a

different approach that provides a new perspective on these

rallies. The comparison basis between the price surges here is the

drawdowns that each of them experienced across their spans. Note

that these drawdowns aren’t to be confused with the cyclical

drawdowns that are used to measure how the price has declined since

the bull run top. The drawdowns in question are the obstacles that

the cryptocurrency encountered while the rallies were still

ongoing, and are hence, those that the coin eventually managed to

overcome. Related Reading: Prices Limit And Slow Down The Number Of

BTC ‘Wholecoiners?’ Here is a chart that shows the degree of

drawdowns that each of the historical bull markets experienced, and

also where the current rally stands in comparison to them: Looks

like the value of the metric hasn't been too high for the latest

rally so far | Source: Glassnode on Twitter The five bull rallies

here are as follows: genesis to 2011 (the very first rally),

2011-2013, 2015-2017, 2018-2021 (the last rally), and 2022 cycle+

(the ongoing one). The analytics firm here has taken the bottom of

each of the bear markets as the start of the next bull rallies.

This means that parts of the cycle that some may not consider as

part of the proper bull run are also included. The main example of

this would be the April 2019 rally, which is often considered its

own thing but is clubbed with the last Bitcoin bull market in the

above chart. From the graph, it’s visible that the deepest drawdown

that occurred during the first bull market measured around -49.4%.

The next run, the 2011 to 2013 bull, experienced an even larger

obstacle of a -71.2% plunge midway through it. The next one

(2015-2017) then only saw a drawdown of -36%, but the drawdown was

again up at -62.6% for the run that followed it (that is, the

latest bull market). Related Reading: Bitcoin Volatility Shrinks To

Historical Levels, Violent Move Incoming? So far in the 2022+

Bitcoin bull market (which would only be considered a bull market

at all if the November 2022 low was truly the cyclical bottom), the

deepest drawdown observed so far is the March 2023 plunge of

-18.6%. Clearly, the drawdown seen in the current rally so far is

significantly lesser than what the historical bull markets face. If

the pattern of the past runs holds any weight at all, then this

would mean that the current bull market should still have more

potential to grow. BTC Price At the time of writing, Bitcoin is

trading around $26,900, down 2% in the last week. BTC has been

moving sideways recently | Source: BTCUSD on TradingView Featured

image from iStock.com, charts from TradingView.com, Glassnode.com

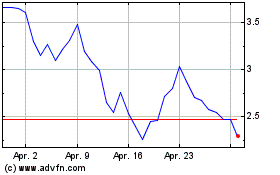

Stacks (COIN:STXUSD)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

Stacks (COIN:STXUSD)

Historical Stock Chart

Von Apr 2023 bis Apr 2024