Bitcoin Bearish Signal: NUPL Finds Rejection At Long-Term Resistance

25 Mai 2023 - 7:00PM

NEWSBTC

On-chain data shows the Bitcoin Net Unrealized Profit and Loss

(NUPL) has found rejection at the long-term resistance zone

recently. Bitcoin NUPL Has Observed Some Decline In Recent Days As

explained by an analyst in a CryptoQuant post, the BTC NUPL metric

has failed to clear a major resistance. The “NUPL” is an indicator

that tells us about the degree of unrealized profit or loss that’s

currently being held by the investors. By “unrealized,” what’s

meant here is that the holders have accumulated profits/losses (due

to the price being more/less than what they purchased the coins

at), but they are yet to actually sell their BTC to set them in

stone. When such investors who are holding unrealized

profits/losses do end up selling eventually, the profits/losses

they were previously holding are said to be “realized.” When the

value of the NUPL is greater than zero, it means the average

investor is carrying a profit on their coins right now. On the

other hand, the indicator being below this threshold suggests the

market as a whole is sitting on some loss currently. The zero value

of the metric itself naturally represents the break-even level, as

the total amount of unrealized profits in the market equals the

unrealized losses at this mark. Related Reading: Bitcoin Hangs At

$26,200: Why This Is A Crucial Support Level Now, here is a chart

that shows the trend in the Bitcoin NUPL, as well as its 365-day

moving average (MA), over the last few years: The value of the

metric seems to have been going down in recent days | Source:

CryptoQuant In the above graph, the quant has marked the “long-term

resistance” zone that the Bitcoin NUPL has seemed to have

historically followed. This area, which lies in between the values

of 0.31 and 0.38, has been an important retest for the

cryptocurrency, as failure here has often meant the start of a

drawdown. When coming from above, however, there have also been

bullish retests of this zone, as the points marked by the green

checkmarks in the chart display. A prominent example of such a

successful retest was back in July 2021, when BTC hit a local

bottom and proceeded with the second half of the 2021 bull run

following it. The example of a bearish resistance appears to have

formed just recently, as the indicator entered the zone recently

but has been rejected downwards. And with it, so has the asset’s

price. It’s uncertain yet, but this rejection may have started an

extended drawdown for the coin. “Given that the NUPL index has also

formed a bearish Head & Shoulders (H&S) pattern, this could

mean that Bitcoin could fall into the $24,000-$20,000 range,” notes

the quant. “With the successful implementation of the H&S, the

local uptrend of the NUPL index will also be broken.” Related

Reading: Bitcoin Sell-Side Risk Ratio Nears All-Time Lows, Big Move

Soon? The Bitcoin NUPL has also shown interesting interactions with

its yearly MA in the past; the indicator has sometimes found

resistance or support at this level as well. “The last frontier for

maintaining Bitcoin bullishness is the 365-day MA, which acts as

reliable long-term support,” says the quant. “For the above

scenario to be declared invalid, it is necessary to overcome

long-term resistance sustainably!” BTC Price At the time of

writing, Bitcoin is trading around $26,300, down 2% in the last

week. BTC has plunged recently | Source: BTCUSD on TradingView

Featured image from iStock.com, charts from TradingView.com,

CryptoQuant.com

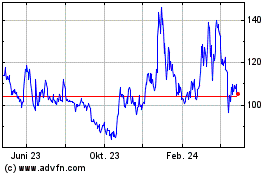

Quant (COIN:QNTUSD)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

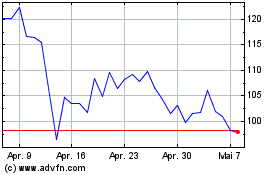

Quant (COIN:QNTUSD)

Historical Stock Chart

Von Apr 2023 bis Apr 2024