The US Fed is Sitting On A $1.2 Trillion Loss On Its Bond Portfolio

14 März 2023 - 6:00PM

NEWSBTC

The United States Federal Reserve (Fed) is sitting on a

$1.2 trillion loss on its $8.3 trillion bond portfolio. Is The FED

Failing? Out of their bond portfolio, the United States central

bank is losing money by paying commercial banks via reverse

repurchase agreements, popularly known as reverse repos or

RRPs. If you thought SVB was bad … The Fed is sitting on

unrealized losses of ~$1.2 trillion on their $8.3 trillion bond

portfolio. And the Fed is losing money every day by paying $$$ to

commercial banks via reverse repos. pic.twitter.com/qBMTq7mR3E —

Wall Street Silver (@WallStreetSilv) March 13, 2023 Reverse repos

are agreements where the central bank, in this case, the

Fed, sells securities, that is, government bonds, to commercial

banks and agrees to repurchase them later at a higher price. This

allows the Fed to inject liquidity into the market, but this has

been coming at a higher cost due to high-interest rates. Related

Reading: USDC Feeling Intense Pressure Despite Fed Action To Halt

SVB Contagion With news showing that the central bank is

hemorrhaging funds after a shift in its monetary policy, there is a

growing concern among investors and financial

experts. The Fed’s bond portfolio is part of its quantitative

easing program following the 2008-2009 global financial crisis. The

idea was for the Fed to buy government and mortgage-backed

securities (MBS) to keep interest rates low and stimulate economic

growth. This worked to some extent, but the downside is that the

Fed is now sitting on many bonds that are losing value on rising

fund rates. Their loss appears worse following the collapse of

banks like Silicon Valley Bank that use customer deposits to buy

government securities. When customers request their money back, the

banks must sell the bonds at a discount, causing losses. To make

depositors of SVB whole, the US government has to step in to

acquire such bonds at face value (reverse repo), which means that

the Fed ends up holding these bonds and their losses. Related

Reading: Bitcoin Bulls Gain Strength, But Is The Fed Really Forced

To Pivot? The situation has raised concerns about the effectiveness

of the Fed’s monetary policy and the impact of government

intervention in the financial markets. Critics have pointed out the

moral hazards behind providing bailouts to failing institutions,

which encourages risky behavior and can lead to a lack of financial

discipline. The founder of hedge fund Citadel, Ken Griffin,

has criticized the government’s decision to bail out

depositors of Silicon Valley Bank, saying it shows that American

capitalism is “breaking down before our eyes.” He believes there

has been a loss of financial discipline and that the government

should not have intervened to protect all depositors, even those

with balances above the federal insurance limit. At the back of

this, Bitcoin prices are rallying, reaching new Q1 2023 highs above

$26,000. Will There Be A Resolution? Some experts argue that the

Fed’s bond portfolio situation is not as dire as it seems. Bonds

are typically held to maturity, which means that unrealized gains

or losses disappear when the bonds are redeemed. Therefore, the

losses only matter if the Fed needs to sell the bonds for

liquidity. Thus, like any bondholder, the Fed is losing to

inflation more than anything else because they have to hold to

maturity. Feature Image From Federal Reserve, Chart From

TradingView

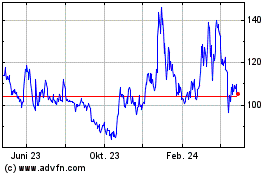

Quant (COIN:QNTUSD)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

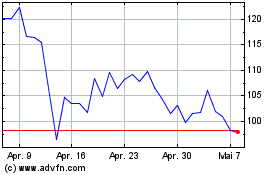

Quant (COIN:QNTUSD)

Historical Stock Chart

Von Apr 2023 bis Apr 2024