Will Bitcoin See A Repeat Of November 2018? A Look At The On-Chain Data

21 Oktober 2022 - 11:23AM

NEWSBTC

The Bitcoin price is lingering just under $19,000 at the time of

writing, not far from the local low of $18,300. When the Consumer

Price Index (CPI) and Producer Price Index (PPI) data was released

last week, the BTC price plunged to just that price level.

Unexpectedly for many, a very quick rebound happened, catching

shorters off guard. With November 02 – when the FED meets again –

in mind, the Bitcoin price doesn’t have much room to fall below

that level at the moment. Moreover, a look at the on-chain suggests

another crash is possible in the short term, although there are

positive signals as well. Related Reading: Bitcoin Price Still

Consolidates, What Could Trigger A Nasty Drop According to

CryptoQuant, a bear market signal appears when the realized price

of all long-term holders (blue line) goes above the realized price

of all coins bought (red line) and when the BTC price falls below

the realized price of long-term holders and the realized price of

all coins. The analysis concludes that the Bitcoin price has been

in a bear market for 124 days. In this respect, the drop from

$6,000 to $3,000 is comparable to the price decline from $30,000 to

$18.000, as the percentage decline in the last bear market from

$6,000 to $3,000 was 50%. That being said, the bottom may not have

been seen yet: The drop from $30.7k to $18.2k was 41%. A 50% drop

from $30.7k would put BTC at $15k (-18% from the current price).

Similar to the $14.7k delta price. Contradictory On-Chain Data For

Bitcoin With Santiment, another major on-chain analysis service

stated that the Bitcoin market needs to ideally see accumulation at

the moment, while small traders remain bearish and spread doom and

gloom. However, contradictory data is showing up in this regard.

Thus, Bitcoin’s small to mid-sized addresses (with 0.1 to 10 BTC)

have recently reached an all-time high of 15.9% of available

supply. At the same time, whales with 100 to 10,000 BTC have

recorded a 3-year low of 45.6% of supply. On the bullish side,

Bitcoin experienced a massive outflow of coins from exchanges on

October 18. Santiment recorded the largest daily volume in 4

months, amounting to 40,572 BTC. With this, the supply of coins on

all exchanges has dropped to 8.48%. This means that the risk of a

future sell-off has decreased at least somewhat. Related Reading:

Bitcoin Dominance To Regain Control Over Crypto? | BTC.D Analysis

October 20, 2022 Bullish data is also reported by the third major

on-chain data provider Glassnode. Bitcoin supply which has not

moved in the last 6 months is approaching an all-time low. It

currently stands at 18.12% of circulating supply or about 3.485

million BTC. Glassnode writes: Historically, very low volumes of

mobile supply typically occur after prolonged bear markets. Jim

Bianco, President of Bianco Research LLC, recently quoted an old

trader’s adage, “Never short a dull market,” which may apply more

than ever to the Bitcoin market. According to his analysis, the

realized volatility meaning the backwardation or actual volatility

is at a 2-year low and is recording one of the lowest levels of all

time. Markets bottom on apathy, not excitement. BTC and ETH have

apathy. The S&P 500 is nearly the opposite, as prices move

around like a video game. This might also be another sign of

the TradFi/Crypto tight relationship breaking. If so, this is

long-run bullish for crypto. Diverging volatility could therefore

be a sign of this shift and ultimately trigger a long-term positive

trend.

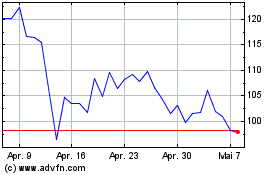

Quant (COIN:QNTUSD)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

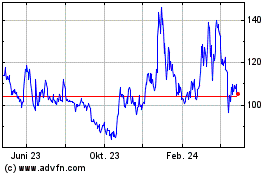

Quant (COIN:QNTUSD)

Historical Stock Chart

Von Apr 2023 bis Apr 2024