Pantera’s Vision: Bitcoin Fund Forecasts $740,000 Price Tag By April 2028

27 November 2024 - 8:30AM

NEWSBTC

As Bitcoin (BTC) prices faced a correction on Tuesday, Dan

Morehead, founder and managing partner of Pantera Capital,

expressed optimism about the cryptocurrency’s future. In a recent

interview, he suggested that the current market challenges could be

temporary and that the rally might not be over. Bullish Future For

Bitcoin Amid Regulatory Shifts Reflecting on Pantera

Capital’s journey since launching its Bitcoin fund 11 years ago,

Morehead acknowledged the skepticism they faced in 2013. “People

totally thought we were crazy in 2013,” he stated, emphasizing the

persistent negativity surrounding Bitcoin. The executive

views this prevailing pessimism as a positive sign, reinforcing his

bullish stance. “So many people are still negative. It’s far from

being a bubble,” Morehead told Bloomberg. Related Reading: Bitcoin

Price Alert: Expert Warns Of Upcoming 25% Drop, Timing And Trends

Explained Pantera’s Bitcoin fund has yielded a substantial lifetime

return of 132,118% since its inception in July 2013, when Bitcoin

was valued at just $74. Morehead predicts that Bitcoin could

eventually reach $740,000, attributing this potential growth to a

changing regulatory landscape. Morehead highlighted the shift

from “15-year regulatory headwinds to tailwinds,” particularly

citing the more crypto-friendly policies expected from the

administration of President-elect Donald Trump. The original

Bitcoin fund launched by Pantera is notable for being the first to

provide US investors with direct exposure to the cryptocurrency.

Having recently traded around $91,000 after nearing $100,000 last

week, the Bitcoin price has surged approximately 120% this year.

Advocating For Crypto Reserves Morehead also discussed Pantera’s

new venture fund, Pantera Fund V, which aims to raise $1 billion to

invest in various blockchain assets, including private tokens and

“special opportunities” such as locked Solana (SOL) tokens from the

FTX estate. “Fortunately, we raised the big fund right before

the industry-wide blowups in 2022,” Morehead remarked, noting that

this timing has allowed them to deploy capital effectively over the

last few years. The company’s founder pointed out that many

“generalist firms” have exited the cryptocurrency space, leaving

fewer competitors in the market. This environment has reportedly

enabled Pantera Capital to secure “better pricing and more

advantageous deals.” Related Reading: BNB Price Sets Up for a

Comeback: Bulls Eye Higher Levels Morehead, who has a background as

a trader at Goldman Sachs, also commented on Trump’s proposal for a

US Bitcoin stockpile. He described the idea as “rational,” arguing

that holding gold as a reserve is an “outdated method” of storing

wealth. “If they put some of that money in Bitcoin, that is a

fantastic way to have a reserve currency holding,” he concluded. At

the time of writing, the leading crypto has regained the $93,000

level, while recording a 1.5% decline in the 24-hour

timeframe. Featured image from DALL-E, chart from

TradingView.com

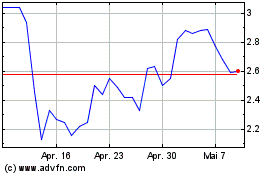

Optimism (COIN:OPUSD)

Historical Stock Chart

Von Okt 2024 bis Nov 2024

Optimism (COIN:OPUSD)

Historical Stock Chart

Von Nov 2023 bis Nov 2024