Easyfi launches new product “Electric” to bring Permissionless Margin Trading capabilities to DeFi using its lending protocol

26 September 2022 - 9:00PM

NEWSBTC

Testnet Launch on Polygon Now Live Decentralized exchanges (DEXs)

have been able to clinch a large market share from centralized

exchanges (CEXs), especially with the creation of more than 20,000

tokens, all with varying degrees of liquidity. However, one area

where DEXs is still lacking is in the margin trading domain. Where

centralized exchanges command more than $200 billion in margin

trading volume daily, DEXs fall short with only a tiny fraction of

this volume. EasyFi, a universal Layer 2 multi-chain lending

protocol, is taking steps to add value to the DeFi space via their

protocol. It has announced a new product called “Electric”, that

allows DeFi users to be able to carry out margin trades outside the

confines of a centralized exchange using its lending protocol.

Extending the Lending Strategy “Electric” is only the latest in

EasyFi’s vision of getting DeFi users to #DoMoreWithDeFi. The

launch of Electric brings to fore the next step in their lending

strategy. This will allow users to obtain short-term loans and use

them to carry out margin trading activities. All of this happens on

publicly sourced liquidity that is available on different automated

market makers (AMMs). Electric users will be able to trade with the

most liquid decentralized exchanges and AMMs through collaborations

that are being explored by the EasyFi team. Lenders of the

liquidity pools can invest smartly by being provided a calculated

risk-reward ratio. Since dedicated pools are created for each asset

pair, lenders are able to understand the risk-reward associated

with each investment right from the start. Perhaps the most

important of these is the user interface of Electric. Like any

decentralized finance protocol, ease of use is important to give

users a seamless experience. Electric is designed with the same

simple, intuitive, and user-friendly interfaces that have come to

be associated with EasyFi products. The Electric Litepaper has also

been published to showcase the idea, motivation & concept

behind Electric, its workings, a step-by-step guide & some core

concepts within EasyFi’s new product for MarginTrading on DEXs.

What To Expect Electric carries a lot of promise for the

decentralized finance space. To this end, the EasyFi team has

outlined some things that users can expect from the product.

Diverse Trading Pairs One avenue that centralized exchanges

continue to dominate is the diverse range of trading pairs that

traders are able to choose from. Electric is expected to have

different trading pairs that will be based on isolated and

independent lending pools available to the traders. To begin with,

the number of tokens to test on will be small, but as time goes on,

these will be expanded and will include both volatile and stable

assets. Margin Markets/Interest Traders who wish to take part in

the margin trading markets will have to deposit collateral to

Electric at first. Additionally, lenders can earn high yields when

they deposit assets directly into the lending pools. They earn from

the interest paid by leveraged traders, as well as other rewards

which will be available only to lenders through exclusive programs.

Lending Pools On Multiple Chains Electric will be a multi-chain

margin trading product. It will start on Polygon first and then

expand to other chains including BSC and other networks.

Community-Centered Eventually, once Electric goes mainnet and

EasyFi launches its DAO, the community will take charge of the

decision-making – such as adding new lending collaterals, setting

default interest rates, adding new margin trading pairs, and

establishing risk parameters and more. Getting Ready For Take-off

Electric has now been launched on the Polygon Mumbai Testnet. It

has made a connection to the QuickSwap Testnet to provide a DEX

integration to complete the trading process. This way, the

community can test out the protocol before it launches on the

mainnet. EasyFi also plans to partner with other DEXs to integrate

them into Electric. For now, community members can test out

leveraged trading on the Electric testnet version starting with a

test asset, xUSDC. Many other tokens and blockchains are planned to

be added during the course of the testing period.

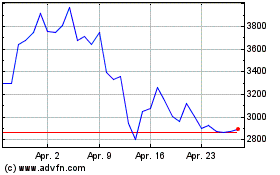

Maker (COIN:MKRUSD)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

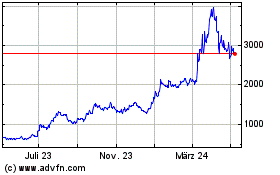

Maker (COIN:MKRUSD)

Historical Stock Chart

Von Apr 2023 bis Apr 2024