How L2 Networks Are Changing The World of NFTs

30 August 2022 - 3:39PM

NEWSBTC

The past few years have seen NFTs explode onto the blockchain

scene, progressing from a relatively unknown technology to one

that’s been papered across the front pages of seemingly every

crypto publication. Alongside the increase in both understanding

and trading in NFTs, the global market has continued to rise,

predicted to reach an incredible $122.43 billion by 2028. With the

expansion of NFTs beyond just digital art, also integrating into

Play2Earn blockchain gaming projects and metaverse creations, this

digital medium is set for a dazzling future. While progress has

been impressive within the world of NFTs, their increased

popularity also comes with a fairly hefty downside – rising gas

fees when processing transactions. The vast majority of NFTs are

minted on Ethereum, with their ERC-721 being the industry standard

for creating new non-fungible digital assets. Although Ethereum’s

infrastructure provides a comprehensive ecosystem where users can

create, distribute, and trade their acquired NFTs, the blockchain

network itself has a notoriously low threshold for transactions per

second, leading to high gas fees. While this was commonly

understood as part of the territory when minting on Ethereum, the

introduction of L2 networks promises to remedy this problem. With

these developments, the longevity and sustainable growth of NFTs

could be much more certain. In this article, we’ll explore the

current state of the NFT market, touching on Ethereum’s gas fees

and the role they play in NFT expansion. We’ll then turn to L2

networks and discuss exactly how the introduction of these

technologies is set to change the industry for the better. Why Does

Ethereum Have High Gas Fees? As a blockchain ecosystem, Ethereum

boasts a range of advantages that have made it into the most

popular chain for development. In fact, of the 4,073 dApps

currently active, over 3,000 of them are developed on Ethereum,

with the range of tools and developer playground that this system

offers being perfect for building. Alongside creating applications,

Ethereum has made a name for itself through its powerhouse

selection of tokens, each offering a distinct function that lends

itself to blockchain development. With the rigorousness of the

Ethereum ecosystem, it’s no wonder that it’s become so popular.

However, this popularity has also led to one of Ethereum’s

weaknesses, its slow TPS speed, to start to impact the system.

Coming in with around 15 transactions per second, Ethereum simply

cannot keep up with its own popularity. When someone attempts to

process a transaction, it joins a queue of other transactions,

waiting until it’s at the front of the queue to then be processed

onto the next block. To skip these queues and ensure an instant

transaction, users have to pay a gas fee – a one-off payment that

pushes their transaction data right to the front of the queue. Due

to the astounding popularity of Ethereum, the queue is typically

very long, with the gas fee required to push a transaction through

averaging around $18. While $18 may already seem a high price to

pay for simply processing a transaction, this is nothing to the May

1st high of $196.64. Although currently at a more stable lower

figure, the range of gas fees which users must pay demonstrates the

instability of Ethereum as a whole, with its own popularity being

one of its central weaknesses. How Do Gas Fees Impact The World of

NFTs? When a digital artist wants to create an NFT, they have to go

through the process of minting their artwork. What this means is

you take your digital file and transform it into a digital asset,

storing its data on the blockchain and minting (printing or

creating) it on an ETH-721 token. Once on the blockchain, you can

then sell your digital asset through smart contracts. The process

of minting an NFT requires that you process a transaction on

Ethereum, needing your transaction to go through to create the

digital asset. Of course, as with any transaction, this means a

user would have to pay the gas fee to push their transaction

through. When a digital artist wants to transform their digital

artwork into NFTs, they must then pay a gas fee on every single

piece that they want to sell. Unless the artist has a significant

following and other buyers waiting to purchase their work, then the

$18 gas fee could pose a major barrier to entry. Quite simply, if a

NFT vendor can’t sell their piece for more than $18, then they’ve

lost money. Even if they were able to sell for around $30, their

margin is significantly dented by the gas fee. With this in mind,

the barrier to entry within the world of NFTs is higher than it

should be, with only artists that can afford to make an initial

investment being able to list their digital assets on marketplaces.

How Do Artists Sell Their NFTs? The first step when artists want to

sell their art online is to sign up for a non-custodial online

wallet. Digital wallets like Ambire allow users to add and collect

funds into their accounts, acting as a highly-accessible location

for any movements of crypto. Ambire has recently become a favorite

within the NFT scene due to its announcement that it will allow

users to prepay for gas fees to reduce their costs in a scheme

known as Gas Tank. Once a user has set up their digital wallet,

they can then turn to any major NFT marketplace to start listing,

buying, and selling their art. As the world’s largest DeFi

exchange, Binance NFT is typically the marketplace that artists go

to when looking to distribute and exchange their art. Alongside

having an enormous customer base that helps new artists to gain

exposure, they also have a roster of exclusive partnerships and

celebrities that actively engage with the platform. For example,

Binance NFT has recently released an exclusive collection with

Franck Muller, a Swiss luxury watchmaker, distributing NFTs of

their watches onto the platform. Another recent headline has been

Mike Tyson’s involvement in the Binance NFT space, releasing a

Mystery Box NFT that users have been flocking to. With the huge

financial and community backing behind Binance NFT, many artists

will start their journey on this platform, minting their NFTs and

selling them to the public through the easy-to-use site. Going

beyond generalist marketplaces, some digital artists turn to more

specific locations to sell themed art. For example, NFT artists

that are interested in popular sports could go to a marketplace

like Maincard, which focuses on NFT and other digital assets that

revolve around major sports matches. Using specific mediums like

this puts digital artists in contact with an audience that is

actively seeking their content. As the world of NFTs continues to

grow, we’re likely going to see many more of these specialist

digital platforms emerge to support niche exploration. How Are L2

Networks Set to Shake Up the World of NFTs? Over recent months,

Ethereum, as well as other major blockchain ecosystems, have been

releasing news around various updates that they’re making, or are

planning, for their networks. One of the main center points that

encompasses Ethereum’s new 2.0 system is the inclusion of Layer 2

systems. Layer 2s are comprehensive extensions to L1, offering a

range of additional features while being integrated into the

central ecosystem. Unlike side-chains, L2 ecosystems use the same

blockchain as their partners, ensuring a high-security assurance,

as well as an easy bridging pathway between them. For example, Boba

Network, integrates directly into Ethereum and aims to increase the

total number of transactions that they can process per second. By

providing Ethereum with the tools and speed it needs to scale its

operations, the Ethereum network can then effectively reduce its

gas fees. By integrating L2 ecosystems that focus on scalability

into L1 systems, this action allows NFT creators to push their

transactions through for a fraction of the total cost. With this in

mind, both sellers and buyers of NFTs instantly gain access to

cheaper prices. When minting an NFT, once L2 has been integrated,

Ethereum users will have a tiny gas fee to pay, making the margin

on any of their sales considerably larger in their favor. Equally,

when users want to buy an NFT on a marketplace, they, too, have to

pay a gas fee to register the transaction of them buying the asset.

For those buying NFTs, the increased scalability that L2s bring to

Ethereum will further drive accessibility. Instead of having to pay

large fees every time they want to buy a certain NFT, they will

only have to pay a smaller gas fee. The benefits to both buyer and

seller within the world of NFTs will help to create a much more

financially accessible space. While many like to focus on the most

expensive NFT sales, with Christie’s auction house bringing in over

$150 million worth of NFT sales in 2021, the reality is that most

NFTs go for around $30. With margins suddenly being expanded by gas

fees of only a few cents, both buyers and sellers are set to

benefit greatly from this technological advancement. Final Thoughts

Although NFTs have had a fairly upward trajectory over the past few

years, the introduction of L2 networks will further facilitate

growth in this field. As L2 networks provide a stronger foundation

for leading blockchains like Ethereum, the scalability problem of

blockchain will be effectively solved, increasing TPS and

decreasing gas fees. For NFT creators that must process

transactions to then sell their digital assets, the decrease in

these fees will lower the financial bar of entry, allowing more

people to get involved with NFTs. That’s not to mention the easier

buying circumstances, with buyers having to pay less when wanting

to transfer an asset into their digital wallet. With the arrival

and vast integration of L2 networks into the world of NFTs, we’re

likely to see a resurgence in their popularity, with NFTs set to

shake up the world of blockchain over the next few years.

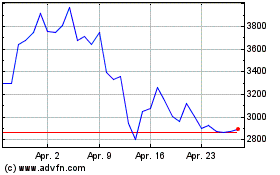

Maker (COIN:MKRUSD)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

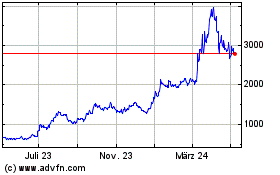

Maker (COIN:MKRUSD)

Historical Stock Chart

Von Apr 2023 bis Apr 2024