Bitcoin Golden Cross Versus Death Cross: Why The Outcome Is Critical

06 Februar 2023 - 9:24PM

NEWSBTC

Bitcoin price is barely clinging on above $23,000, with the outcome

over the next several days being extraordinarily critical for the

fate of the crypto market. On daily timeframe, BTCUSD ticks

ever closer toward a golden cross. Meanwhile, the weekly timeframe

is just inches away from a death cross. Will bulls or bears

ultimately win? Bitcoin Inches Toward Daily Golden Cross &

Weekly Death Cross Bitcoin has had a strong start to 2023, ranking

as the top performing mainstream asset thus far. It’s helped pick

up the broader crypto market, with altcoins outperforming. The

recent rally has also brought BTCUSD just moments away from a

golden cross. Related Reading: Bitcoin Weekly RSI Reaches

Line Between Bear & Bull Market But a more than 50% recovery

from bear market lows still might not be enough to fend off a

higher timeframe death cross taking place on the weekly. The

golden cross (left) versus the death cross (right) | BTCUSD on

TradingView.com This is especially important of an inflection

point, because a golden cross is a buy signal, while the death

cross is a sell signal. Bulls will have to push Bitcoin

significantly higher this week to narrowly avoid a death cross on

the one-week. Bears, however, must strike within 24-48 hours to

have any chance of preventing a golden cross. Double-Crossed

For A BTCUSD Double Bottom? A golden cross happens when a short

term moving average crosses above a long term average from below.

In this case, it’s the 50-day MA and 200-day MA. A death cross is

the opposite sell signal, crossing downward from above

instead. Related Reading: Bitcoin Monthly Signals Stack

Suggesting Bulls Are Ready To Stampede This showdown of moving

averages is especially critical. Such a cross sends a signal about

the longer term trend. Even more important yet is the fact that

BTCUSD weekly timeframes have never experienced a death cross,

making it an anomaly in terms of price history and what to

expect. A comparison of the same setup circa 2015 | BTCUSD on

TradingView.com The higher the timeframe, the more dominant the

signal, possibly putting the outcome in the favor of bears.

Narrowly escaping a death cross on the same timeframe led to one of

the greatest bull runs in crypto history (pictured above).

The last time BTCUSD nearly death crossed on the one-week was in

late 2015. At that time Bitcoin did successfully golden cross on

the daily and prevent the weekly death cross. Unfortunately, the

golden cross didn’t sustain, crypto was rejected to a double

bottom, and BTCUSD death crossed and then golden crossed again

before taking off from around $200 to $20,000. The Battle of

#Bitcoin Bulls & Bears in Moving Averages. Bulls are pushing

for a daily golden cross while bears want a weekly death cross. Who

wins? pic.twitter.com/IzRkjAPHXf — Tony "The Bull"

(@tonythebullBTC) February 6, 2023 Follow @TonyTheBullBTC on

Twitter or join the TonyTradesBTC Telegram for exclusive daily

market insights and technical analysis education. Please note:

Content is educational and should not be considered

investment advice. Featured image from iStockPhoto, Charts from

TradingView.com

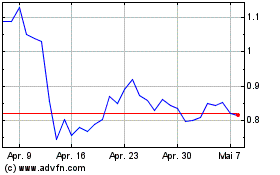

Mina (COIN:MINAUSD)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

Mina (COIN:MINAUSD)

Historical Stock Chart

Von Apr 2023 bis Apr 2024