Solana (SOL) Retests Multi-Month Trend Line, Bulls Prevailing Again?

01 Mai 2023 - 3:10PM

NEWSBTC

Sunday night’s crypto market-wide correction has once again sent

the Solana price down to a level that is crucial for price action

in the coming weeks. SOL has been forming an ascending trend line

on the 1-day chart since late December last year, which could lead

the price back into bullish territory, as NewsBTC reported. Already

in the last few days, the Solana price had tested the trend line

(black) before a decent bounce to the upside took place. However,

yesterday’s price action pushed SOL back to the trendline. However,

as the 4-hour chart shows, SOL has shown strength and remained

above the trendline. The retracement has also caused Solana’s

Relative Strength Index (RSI) to reset on the 4-hour chart. With

the RSI near the overbought zone at 68, there has now been a

healthy pullback to 41. Thus, the 4-hour chart continues to look

bullish. A look at the 1-hour chart continues to show a similarly

strong picture. For SOL’s bulls, today is all about closing above

the $22 level to stay above the trendline. If successful, the bulls

can once again tackle resistance at $22.78 before the big

challenge: the 200-day Exponential Moving Average (EMA) (blue).

Solana already fell below the “bull line” on April 8, 2022, which

technically means it is still in bear territory. The collapse of

FTX and the entanglements are certainly one reason why SOL is still

undervalued compared to other altcoins. Related Reading: Solana

(SOL) Price Holds Ultra Strong, Bulls Target $25 Today? While

numerous altcoins are already trading above the 200-day EMA, the

indicator remains the most important target for Solana. However,

this will likely require a renewed upswing in the overall crypto

market, especially in the leading cryptocurrency Bitcoin. Once the

200-day EMA falls, Solana’s yearly high at $27.13 comes into focus,

where the 38.2% Fibonacci level is also located. Subsequent

Fibonacci levels would be $33.06 (50% Fibonacci), $39.14

(61.8%Fibonacci), and $47.81 (78.6% Fibonacci). Related Reading:

Solana Faces A Trend Decision, But The Bull Case Prevails

Remarkably, Solana’s current strength can also be seen in the

SOL/BTC chart (1-day chart). SOL is on the verge of breaking out of

a descending parallel channel that has defined Solana’s trend since

mid-January. Bullish News For Solana Last Friday, payments giant

Mastercard announced that it is working with a handful of layer 1

projects to create common standards. Among them is Solana. In

addition, Mastercard has selected the blockchains: Ethereum, Aptos,

Polygon and Avalanche. The Solana Foundation commented via Twitter:

The Solana Foundation is excited to work with Mastercard on tools

to verify trusted interactions and help secure interactions between

web2 and web3 apps. This is a positive step forward in enabling

trust in trustless environments for consumers, businesses, and the

greater. At #Consensus23, we announced how we are instilling trust

in the blockchain ecosystem through Mastercard Crypto Credential.

With crypto wallet providers @Bit2Me_Global, @LiriumAG ,

@MercadoBitcoin and @UpholdInc and public blockchain network

organizations @AptosLabs,… pic.twitter.com/P33mtDVAas — Mastercard

News (@MastercardNews) April 28, 2023 Featured image from Exodus

Wallet, charts from TradingView.com

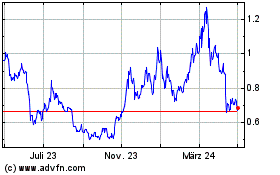

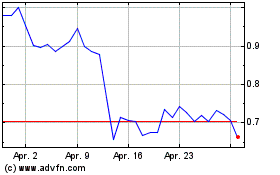

Polygon (COIN:MATICUSD)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

Polygon (COIN:MATICUSD)

Historical Stock Chart

Von Apr 2023 bis Apr 2024