Bitcoin Bearish Signal: NVT Golden Cross Enters Overbought Zone

26 April 2023 - 5:10PM

NEWSBTC

On-chain data shows the Bitcoin NVT Golden Cross has entered into

the overbought region, something that could be bearish for the

price. Bitcoin NVT Golden Cross Has Been Going Up Recently As

pointed out by an analyst in a CryptoQuant post, the most recent

touch of this zone led to a drop in the price of the

cryptocurrency. The “Network Value to Transactions” (NVT) is an

indicator that measures the ratio between the market cap of Bitcoin

and its transaction volume (both in USD). What this metric tells is

whether the asset is overpriced or underpriced right now, based on

how the value of the network (the market cap) compares with its

ability to transact coins (the transaction volume). High values of

the indicator suggest the cryptocurrency’s cap is inflated compared

to its volume, and hence, the coin’s price may be overvalued

currently. Similarly, low values can imply the asset may be

undervalued at the moment. Now, a metric derived from the NVT is

the “NVT Golden Cross,” which compares the 30-day moving average

(MA) of the NVT with its 10-day MA. By taking the ratio of the

long-term and short-term trends like this, the indicator can help

point out the tops and bottoms in the NVT. Here is a chart that

displays how the value of the Bitcoin NVT Golden Cross has changed

over the past year: The value of the metric seems to have been

climbing in recent days | Source: CryptoQuant As shown in the above

graph, the quant has marked the historical regions where the

Bitcoin NVT Golden Cross has signaled underbought and overbought

conditions for the asset. It looks like the values of the metric

above 2.2 have been a sign that the cryptocurrency is undersold,

while those below the -1.6 level have implied an oversold

condition. Related Reading: Bitcoin Market At Decision Point: aSOPR

Retests Crucial Level From the chart, it’s visible that the

indicator touched the underpriced region last month, and the price

reacted by observing some bullish momentum. Since then, the metric

has seen an overall uptrend. A week or so ago, when Bitcoin was

floating around the $30,000 level, the NVT Golden Cross entered

inside the overpriced region. Following this formation, the price

faced some severe drawdown as it plunged to the low $27,000 level.

The metric cooled down for a while following this selloff, but in

the past couple of days, it has once again risen to touch the red

zone. This would mean that the asset may be becoming overbought

again. Over the past day, however, Bitcoin has actually only

observed some strong upwards momentum, as the coin’s value has now

recovered to levels above $29,000 again. Related Reading: Polygon

Exchange Supply Spikes, More Downtrend Incoming? In the past, tops

haven’t always been immediately formed whenever the NVT Golden

Cross has surged to this area, so this wouldn’t exactly be

unprecedented. However, considering that the surge may have only

made the coin more overpriced, a local top may be hit soon for the

asset, if this metric’s pattern is anything to go by. BTC Price At

the time of writing, Bitcoin is trading around $29,400, up 1% in

the last week. Looks like BTC has sharply surged over the last 24

hours | Source: BTCUSD on TradingView Featured image from mana5280

on Unsplash.com, charts from TradingView.com, CryptoQuant.com

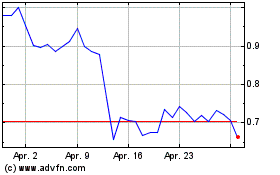

Polygon (COIN:MATICUSD)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

Polygon (COIN:MATICUSD)

Historical Stock Chart

Von Apr 2023 bis Apr 2024