MakerDAO Is Raking Big Money, But Why Is It Under Fire?

08 März 2023 - 10:00PM

NEWSBTC

MakerDAO, one of the first and largest DeFi protocols on Ethereum,

is raking in millions of dollars. Even as it remains successful,

the decentralized money market is under immense pressure from its

community. MakerDAO Makes $2.1 Million On March 8, MakerDAO said it

made $2.1 million in lifetime fees from their MIP65’s $500 million

short-term bond investment strategy in January 2023. They went on

to say this figure represented almost 50% of their annualized

revenues. Fees generated were mainly from the yield on DAI, the

algorithmic stablecoin issued and managed by MakerDAO. Related

Reading: MakerDAO Passes Proposal To Deploy $100 Million USDC In

Yearn Finance Vault Under this investment strategy, dubbed MIP65 or

Monetalis Clydesdale, approved by the community in 2022, MakerDAO

can get exposure to short-term bonds exchange-traded funds

(ETFs). MakerDAO said the goal is to “onboard a real-world

asset (RWA) Maker Vault with a debt ceiling of 500 million DAI that

will acquire USDC and invest them in approved bond strategies.” 1️⃣

MIP65: Monetalis Clydesdale: Liquid Bond Strategy & Execution

This MIP aims to onboard a real-world asset (RWA) Maker Vault with

a debt ceiling of 500 million DAI that will acquire USDC via the

PSM and invest them in approved bond strategies. →

https://t.co/6tZkoGK1Bj 2/ — Maker (@MakerDAO) October 4, 2022 MKR

holders voted to invest specifically in a composition of US

Short-Term Treasuries and a small percentage in corporate bonds.

MKR is the governance token of MakerDAO. Since this investment is

off-chain, all prices are tracked through an oracle deployed on

Polygon, an Ethereum sidechain. All these operations are automated

and guided by audited smart contracts. The decision to use smart

contracts on Polygon is strategic and intentional. Since the

protocol is a DAO, there must be transparency for MKR holders who

vote on proposals, including the decision to create an off-chain

investment strategy. Related Reading: MakerDAO Invests Hefty

Amount Becoming The Largest Stake Holder In USDC As of March 8,

MakerDAO’s MIP65 tracker showed that the protocol held $351.4

million of IB01: iShares $ Treasury bond 0-1 year UCITS ETF and

$150.6 million of IBTA: iShares $ Treasury bond 1-3 year UCITS ETF.

The protocol also bought IB01 in the first week of December 2022

before holding off. They have been gradually buying these ETFs

since mid-October 2022. Considering the success of MIP65, there are

plans to increase investment from $500 million DAI to $1.25

billion. The extra $750 million will go “into a 6-month US Treasury

ladder strategy with bi-weekly maturities.” MakerDAO is reviewing a

proposal to extend its existing US treasury bond investments from

$500 million to $1.25 billion. pic.twitter.com/DZj72oTJvP — Maker

(@MakerDAO) March 7, 2023 Borrowing DAI Using MKR Opposed However,

it is a bold initiative by MakerDAO to permit MKR holders to borrow

DAI. Critics say this model is similar to the mechanism behind

UST, the algorithmic stablecoin by Terra that de-pegged, pulling

down LUNA with it. Hmm looks a lot like backing $UST with its

governance token $LUNA. Did @stablekwon secretly infiltrate

@MakerDAO? https://t.co/3u6NzOMkPK — Arthur Hayes (@CryptoHayes)

February 24, 2023 Some even say implementing this style would mean

an exit scam via DAI without giving out control of the protocol,

but these comments are rumors as of this writing. Feature

Image From Canva, Chart From TradingView

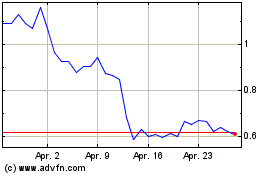

Terra (COIN:LUNAUSD)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

Terra (COIN:LUNAUSD)

Historical Stock Chart

Von Apr 2023 bis Apr 2024