Ethereum: Several Metrics On The Down-Low As Shanghai Upgrade Nears

08 März 2023 - 8:40AM

NEWSBTC

Ethereum, the Layer 1 blockchain for most of the DeFi protocols

available in the market, has seen drops both in metrics and in

price since the start of the month. According to CoinMarketCap, the

price of Ethereum went down by 6% in the weekly timeframe, and

trading at $1,554. Nansen.ai, on the other hand, has been noting

several key metrics that investors should watch out for as

Ethereum’s Shanghai upgrade rolls closer to frame. Meanwhile,

DeFi has taken a blow from the recent volatility in the market.

Total value locked (TVL) of DeFi has gone down by a percent, a

figure that might not be so alarming but could still bring in some

negative energy for investors. Related Reading: Shiba Inu Is The

Crypto Of Choice By Top 100 Ethereum Whales – Here’s Why Markets

Down, Investors Dragged According to a recent thread made by the

company, Ethereum has been showing signs that both retail and

institutional investors have bearish attitudes that contribute to

the overall market depression seen right now. Source: CoinMarketCap

In the simplest of explanations, traders are said to be more

efficient at selling at the highs than buying at the dip. ‘Dip

Buyers’, a category in Nansen’s report, only counted 23 traders

that fit this category. Join Nansen Research’s new Telegram

channel: https://t.co/znbFCUCPZZ 🔔 Be the first to know when our

latest reports are published. pic.twitter.com/i75zeOxAy4 — Nansen 🧭

(@nansen_ai) March 6, 2023 Sellers are also disposing more ETH to

the open market. The Top Seller segment of the report also shows

that they sold over 335k ETH. Investors that experienced a $40k

profit are also avoiding ETH with a 50% decline in the metric. This

can be attributed to external events that heavily impacted the

markets, namely the Terra collapse. Short to medium term,

it’s not looking great for Ethereum either. CoinGlass data shows

that short sellers outnumber the longs by a percentage which

contributes to the overall marker dip as of press time. Macro Woes

Work Hand In Hand With The Bears Recent macroeconomic news are

pummeling the broader market as US Federal Reserve Chair Jerome

Powell announced that the Fed might be eyeing more rate hikes in

the coming months. This came after February’s Year-on-Year Consumer

Price Index report that shows only a 0.1% decrease in CPI from 6.5%

to 6.4%. Before the release of the CPI data, analysts are bullish,

forecasting a YoY CPI OF 6.2%. This set off financial markets

to start the day low as bears enter, dragging the crypto market as

well. All this comes before the release of Ethereum’s Shanghai

upgrade. This can be bad news for ETH as it can be a repeat of the

Merge event for the altcoin. Crypto total market cap at $988

billion on the daily chart | Chart: TradingView.com Related

Reading: Bitcoin Backpedals To $22,000 Region Amid Worries About

Silvergate The Merge was a hyped up event where Ethereum moved from

proof-of-work (PoW) to proof-of-stake (PoS) which was hoped to

bring investors some gains. However, the market saw significant

losses that overshadowed the event. If the Shanghai upgrade

follows the Merge’s footsteps, investors might be faced with gains

or losses as the macroeconomic situation either improves or not.

-Featured image from The Motley Fool

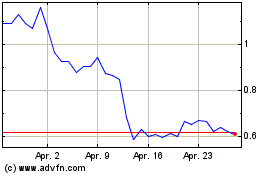

Terra (COIN:LUNAUSD)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

Terra (COIN:LUNAUSD)

Historical Stock Chart

Von Apr 2023 bis Apr 2024