XRP Bullish Cross Is Looming, An Easy Path Toward The $2 Mark?

01 März 2023 - 8:30PM

NEWSBTC

XRP has traded sideways for most of February, but there are bullish

signals for investors to expect a break above the resistance line

and another rally to new annual highs. The token used by payment

company Ripple has constantly consolidated, trading between $0.37

and $0.40 for the past month. For a moment, XRP bulls lost the

strength to continue the January break of the downtrend. Still, as

of this writing, XRP targets the next resistance level at $0.40,

with indicators showing bullish momentum. XRP is trading at $0.3815

and has found support at the $0.37 level. In the short term, the

token closed the month just below its 20-day moving average (MA). A

close above would have been a win for XRP bulls in the short term,

but with solid support and the 20-day MA approaching the bullish

crossover, XRP could establish a new trend for March. The

critical medium-term resistance for bears is the $0.54 level, a

zone that bulls have not reached since October 2022. If XRP climbs

to this zone and consolidates above the $0.5 level, it could target

a retest of the $0.65 resistance, an area lost during the early

days of the crypto winter. Related Reading: Is Ethereum Following A

Deadly Nasdaq Dot Com Fractal? These Indicators Reveals Critical

Variables For XRP According to the crypto trader and analyst,

EgragCrypto, on a Twitter post, the Moving Average

Convergence/Divergence (MACD) follows the trends and momentum of

the price action. This indicator is on the verge of a bullish cross

for XRP. MACD can identify potential reversals in price

action when used with support and resistance levels to find price

points where the trend may change direction across different time

frames. For EgragCrypto, the bullish cross on the MACD, with the

Relative Strength Index (RSI) positioned around the 16 levels in

oversold territory, provides a launch pad to move towards the

oversold region, with a breakout of the nearest resistance points.

With the RSI in oversold territory, bulls could expect a reversal

into overbought territory, giving them the momentum to consolidate

above the nearest resistance at the $0.4 level. The crypto

analyst also used the Average Sentiment Oscillator (ASO), which

shows the depth of market volatility and the strength/weakness of

currencies, to analyze the probabilities of the next uptrend; the

analyst concluded four leading indicators of the possible break of

consolidation: Depth of Market Volatility: HIGH Strength &

Weakness of the trend: STRONG Indicates Market Trend: BULLISH

CROSS level of stability to project possible Trend of a price

movement: PRICE STABLE FOR ALMOST 4 MONTHS The bulls seem to have

the upper hand over the bears. If XRP breaks out of the 6-month

consolidation and places itself above the resistance walls, the

price action may approach areas last seen before the Terra

collapse. Related Reading: Shiba Inu Price At Pivotal Point, Only

352 Million SHIB Burned In February XRP is trading at $0.37, up

0.4% over the past 24 hours. The token has been dropping in the

broader time frames and is trading below its 20-day MA, with a

decrease of -2.9% in the last 24 hours. In the 14-day and

30-day time frames, XRP has seen a decrease in its growth of -2.9%

and -8.4%, respectively, and is still trading down -51.4% from a

year ago. Featured image from Unsplash, chart from TradingView.com.

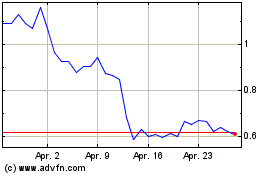

Terra (COIN:LUNAUSD)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

Terra (COIN:LUNAUSD)

Historical Stock Chart

Von Apr 2023 bis Apr 2024