ETH Struggles To Break Past $1,300 Resistance – Back To $1K?

27 September 2022 - 8:33AM

NEWSBTC

ETH, post-merge, has taken traders and investors on a thrilling

adventure. The value of Ethereum has decreased by a stunning 26.36

percent since the much-hyped Merge. The token’s recovery from June

to August was fully erased by this decrease and the market

catastrophe on September 13. Fears of a further decline for the

token are palpable as the price struggles to break through the

61.80 Fib level, currently at $1,329, following the U.S. Federal

Reserve’s interest rate hike announcement. This might indicate

that prices will continue to fall. Related Reading: Algorand: ALGO

Price All Go With Nearly 30% Rally In Last 7 Days ETH On A

Downward Trajectory There was a precipitous drop in ETH’s price

from September 13-19, fairly dissimilar to the drop in May and June

but far lower in magnitude. The result is the same, though; a

dramatic drop in investor trust in both the token and the ecosystem

as a whole. The ETH TVL hasn’t improved much after the switch to

proof-of-stake. It fell from $34.63 billion to $30.38

billion between September 13th and 19th, the same time period

as last year, which is a massive decline of 12.27%. As of this

writing, the price of the coin oscillates above and below the

$1,300 area. This can be understood as a continual conflict between

bulls and bears. Additionally, ETH encountered a rejection wick

earlier today, September 26. However, this bearish trend could be

short-lived. Related Reading: Litecoin Price Watch: Why Only 15% of

LTC Holders Are Making Profit Likelihood Of A Positive Price

Momentum ETH has shown indicators of possible positive momentum on

the micro and macro levels as of today. This can serve as a glimmer

of optimism for ETH traders and investors. The Stoch relative

strength index has been increasing from oversold area. This

indicates that the bulls are gathering momentum, which could propel

ETH past the $1,300 price resistance. ETH has already

accomplished this on both the micro and macro scales as of this

writing. On the 1-hour chart, Ethereum bulls are currently

attempting to consolidate their position above the indicated

resistance in order to convert it into a support. he momentum

indicator is trending upwards. However, this is likely merely a

tiny pump-in cost. As the price fell 4.04% between the end of

September 25 and the beginning of September 26, traders may be

buying the dip. This price decline may give day traders with an

investment opportunity. ETH total market cap at $162 billion on the

daily chart | Source: TradingView.com Featured image from

CryptoMode, Chart: TradingView.com

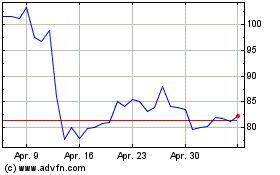

Litecoin (COIN:LTCUSD)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

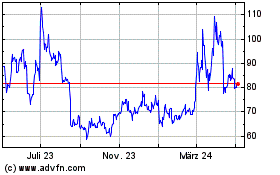

Litecoin (COIN:LTCUSD)

Historical Stock Chart

Von Apr 2023 bis Apr 2024