Bitcoin Bloodbath: Market Volatility Sparks Panic, Wipes Out $1 Billion In Open Interest

27 April 2023 - 11:00PM

NEWSBTC

In the last 24 hours, Bitcoin (BTC) has experienced a sharp

increase in volatility, with prices fluctuating between $29,000 and

$27,000, given the lack of liquidity in the market. This sudden

price action has had a significant impact on bulls and bears.

However, as of this writing, Bitcoin has managed to recover the

$29,000 level, and it remains to be seen if it can continue to

recover and consolidate above its key psychological level of

$30,000, supporting the continuation of its bull run or if it will

be further slumps in the coming days or weeks. Related Reading:

Shiba Inu Whales Unload Billions Amid SHIB Price Retreat False

Rumors Cause Bitcoin Investors To Liquidate In Droves According to

Satoshi Club, the rumors of the US government and Mt. Gox sales

were initially believed to be true, leading to panic selling among

Bitcoin traders. However, it was later confirmed that the data was

misclassified, and no such sales were taking place. The impact of

these rumors on the market was significant, as traders were already

on edge due to the high levels of volatility in the market. The

news of potential large-scale sales by the US government and Mt.

Gox, a now-defunct Bitcoin exchange, only added to the uncertainty

and fear among traders. The market panic led to liquidating $300

million worth of positions as of this writing and the wiping out of

$1 billion in open interest within 24 hours. This was a significant

blow to both long and short traders, as many were forced to exit

their positions at a loss. Open interest can impact the price of

Bitcoin because it reflects the level of market participation and

sentiment. When open interest is high, it suggests greater interest

and activity in the market, potentially leading to price movements.

However, the market has since recovered, and Bitcoin’s value has

risen again. The Funding Rate has returned to around 0.003,

indicating that traders are no longer overleveraged, and the open

interest has also decreased, indicating a lack of significant

activity in the market. Will BTC Reclaim The $30,000 Mark? Material

Indicators, a leading cryptocurrency analytics provider, has

analyzed the Weekly BTC/USDT chart, which shows bid liquidity

moving up and ask liquidity moving down. According to Material

Indicators, when bid and ask liquidity becomes more concentrated

around a price point, it dampens volatility, leading to a sideways

chop until one side makes a move. Per Material’s analysis, this

type of price action differs from what was observed yesterday, as

bids and asks were initially moving up, indicating a clear path for

a pump. However, as things started getting “toppy,” asks began

dropping down, ultimately dumping into the liquidity void created

on the way up. Furthermore, CryptoCon, a leading provider of

cryptocurrency analysis, has highlighted the recent drop in

Bitcoin’s value, which saw a 15% decline. This drop has allowed the

Chaikin Money Flow (CMF) indicator to reset slightly, as it nears

dangerously close to hitting the Mid-Top .35 line. The CMF

indicator is a technical analysis tool that measures buying and

selling pressure in the market. When the CMF is above zero, buying

pressure is stronger than selling pressure, and vice versa when it

is below zero. The Mid-Top line at .35 represents the halfway point

in the cycle for Bitcoin’s true gains. According to CryptoCon, the

mid-top cycle for Bitcoin is approaching soon, but it is only half

of the “true gains” for Bitcoin in a cycle. This means there is

still significant potential for Bitcoin to experience further gains

in the market. Related Reading: Filecoin Price Struggles To Move,

Will It Surpass The $6 Barrier? Featured image from Unsplash, chart

from TradingView.com

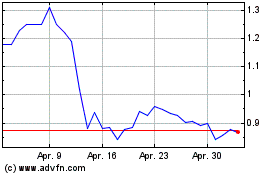

Flow (COIN:FLOWUSD)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

Flow (COIN:FLOWUSD)

Historical Stock Chart

Von Apr 2023 bis Apr 2024