Ethereum Fees Hit 9-Month High Amid Strong DeFi Activity – Details

14 Dezember 2024 - 2:30PM

NEWSBTC

The price of Ethereum recorded an overall decline of 2.08% in the

past week in line with the general performance of most altcoins.

While the prominent cryptocurrency struggles to make any

significant breakout past $4,000, certain developments on its

underlying network have drawn investors’ attention. Related

Reading: Ethereum Price Aims Higher: A Smooth Path To $4,000 and

Beyond? Ethereum Weekly Fees Rise By 18% Amid DeFi Ecosystem Boom

In a recent report on December 13, crypto analytics company

IntoTheBlock stated that weekly Ethereum network fees rose by 17.9%

in the past week reaching an estimated $67 million – the

highest-ever value since April. According to analysts at

IntoTheBlock, these high network fees can be attributed to ETH’s

price balancing as Bitcoin retraced to $100,000. In addition, there

has been a significant increase in DeFi activity on the Ethereum

blockchain. Providing more insight into Ethereum’s vibrant

DeFi ecosystem, the Satoshi Club highlights that DeFi lending has

been on the rise, with traders leveraging their Wrapped Bitcoin

(WBTC) and Wrapped Ethereum (WETH) to borrow stablecoins. These

wrapped assets allow users to maximize their collateral utility by

tapping into the liquidity and stability of DeFi protocols while

maintaining exposure to major cryptocurrencies i.e. Bitcoin and

Ethereum. Notably, the demand surge for lending drove

interest rates to exceptional levels, now exceeding 10% on average

and reaching as high as 40% on certain platforms. Interestingly,

these figures mirror the peak dynamics seen in the 2022 bull

market. Aave, one of Ethereum’s major DeFi protocols with a TVL of

$22.46 billion has been a focal point on this increased DeFi

activity, recording an impressive $500 million in net inflows over

the last week. While heightened network activity driven by

increased DeFi activity can indicate growing interest in the

Ethereum network, investors should note that elevated Ethereum fees

will pose challenges for smaller users being rewarding only for

those who can capitalize on high interest rates. Related

Reading: Ethereum Price Preps for Breakout: Will Bulls Drive a

Massive Upswing? ETH Price Overview At the time of writing,

Ethereum trades at $3,914.08 reflecting a minor loss of 0.22% in

the past day. On the other hand, the altcoin is up by 21.39%

on its monthly chart representing its stellar performance in the

past few weeks As earlier stated, Ethereum’s most immediate

resistance is the $4,000 price zone which has offered much

opposition to price growth since the start of December. By breaking

past this price barrier, Ethereum is likely to surge to $4,900

which represents its current all-time high and next significant

price resistance. With a market cap of $471.16 billion, Ethereum

remains the second-largest cryptocurrency representing 12.9% of the

total digital assets market. Featured image from Empiricus, chart

from Tradingview

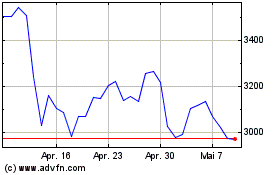

Ethereum (COIN:ETHUSD)

Historical Stock Chart

Von Nov 2024 bis Dez 2024

Ethereum (COIN:ETHUSD)

Historical Stock Chart

Von Dez 2023 bis Dez 2024