The Bitcoin Rollercoaster: Why Every Upward Move Is Followed By A Steep Drop?

24 Mai 2023 - 11:20PM

NEWSBTC

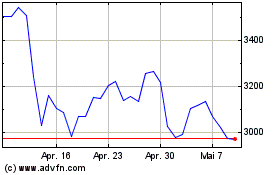

Bitcoin (BTC) has failed to hold onto gains over the past few

weeks, giving back nearly all price increases shortly after they

are made. According to crypto analyst and trader Daan Foppen, this

phenomenon can be attributed to the outsized influence of futures

markets on Bitcoin’s price action. Foppen notes that Bitcoin’s spot

market, where investors buy and sell actual BTC, has been mainly

selling recently, as evidenced by the downtrend in spot market

prices. In contrast, moves upward in Bitcoin’s price have been

driven primarily by activity in futures markets, where traders

speculate on the future price of BTC using leverage. Related

Reading: Crypto Market Alert: Tether Market Cap Fuel Hopes For

Major Rally Bitcoin’s Downward Spiral Continues “The moves that are

made are mostly made with borrowed money, and these kinds of things

are not sustainable for a market,” says Foppen. Whether

stablecoin-margined or coin-margined, futures markets have been the

driving force behind short-term price impulses in Bitcoin recently.

However, the buying power used to move prices upward ultimately

evaporates, leading to gains to be given back. When futures

dominate trading, the underlying spot market struggles to keep up.

Price gains outpace actual buy demand for Bitcoin, leaving the

market susceptible to abrupt reversals once futures buying power

subsidies. This concept has been displayed clearly on Bitcoin price

charts over the past month, with initial price spikes evaporating

quickly. Furthermore, according to Daan Foppen, recent volatility

and price reversals in Bitcoin have been driven largely by

leveraged trading and liquidations in futures markets. Foppen

argues that the cryptocurrency’s price action over the past several

weeks has been characterized by “impulsive moves” upward and

downward that seem forceful but lack strength and sustainability.

For example, Bitcoin’s move to $27,400 on May 23 was mainly fueled

by short liquidations, as overleveraged short positions were wiped

out, creating a “snowball effect” upward. The subsequent sharp drop

was similarly driven by the liquidation of long positions that had

opened during the consolidation period with the expectation of

higher prices. BTC’s Increased Leveraged Positions Moreover, Foppen

points out that interest in Bitcoin futures has risen, indicating

increased leveraged trading activity. However, it is difficult to

determine whether new positions are predominantly short or long.

Funding rates, which indicate whether longs or shorts are paying

interest to balance the market, have been slightly positive

recently but remain around the baseline. Still, Foppen believes the

ingredients are in place for “a deeper flush downwards” in

Bitcoin’s price due to the likelihood that recently opened

positions are mainly longs. “What you shouldn’t do now is blindly

click the short button,” he warns. With highly leveraged and

unstable dynamics currently driving Bitcoin’s price action, Foppen

cautions that these are “very shaky conditions,” protecting one’s

capital should be the top priority for traders. “What you should

especially not do is let yourself get chopped up in this market,”

he says. Related Reading: Ethereum Staking Hits Over $40

Billion After Shanghai Upgrade: What It Means For ETH As of this

writing, BTC is trading at $26,200, down over 3% in the last 24

hours. However, the largest cryptocurrency in the market may

potentially stop its potential continuation of the downtrend at the

200-day Moving Average placed at $24,900, which may serve as a

threshold for bulls. Featured image from iStock, chart from

TradingView.com

Ethereum (COIN:ETHUSD)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

Ethereum (COIN:ETHUSD)

Historical Stock Chart

Von Apr 2023 bis Apr 2024