Number Of Ethereum Addresses In Profit Hits 10-Month High As ETH Continues Rally

24 März 2023 - 9:00PM

NEWSBTC

After several spikes since the beginning of the year, up over 40%

from January, Ethereum investors have profited, translating into

key metrics. According to the on-chain analysis firm Glassnode, the

number of Ethereum addresses in profit has now hit a 10-month high

of nearly 64 million. This comes after ETH dipped below

$1,200 last year, allowing investors to accumulate more

cryptocurrency. These investors are profiting from its price spike

to above $1,800 on Thursday. Related Reading: Ethereum Price Rally

To $2,000 On The Horizon, As Bears Show Weak Hands Profitable

Ethereum Addresses Increasing According to data from Glassnode, the

total number of addresses that are in profit (7D MA) has now surged

to a 10-month high of approximately 63 million. Notably, this is

not the first time Ethereum will push its total number of addresses

in gain to a figure nearing 64 million. Before the latest

recorded number of addresses in profit, the previous 10-month high

sat at around 63.9 million as of March 23, according to the same

source. Meanwhile, Ethereum hasn’t been the only crypto to see a

spike in profitable investors. Earlier this month, Glassnode

reported that the total number of Bitcoin (BTC) addresses worth a

million dollars or more surged to more than 67,000, slightly higher

than the amount of 65,000 in January earlier this year when BTC

first crossed $20,000 in months. Furthermore, Glassnode announced

earlier today that Ethereum non-zero addresses had reached a new

ATH of 96 million. This data suggests that more people are buying

the cryptocurrency amid the bullish price action. Related

Reading: Ethereum Bullish Signal: $560M In ETH Exits Exchanges ETH

To Continue Rally? Over the past two weeks, ETH price has rallied

by nearly 10%, from a low of $1,723 on March 17 to as high as

trading at $1,845 on March 23. Though at the time of writing, the

asset is seeing a retracement down by 3.7% in the last 24 hours

with a trading price of $1,775. Meanwhile, looking at the

1-day time frame, it seems as though the asset’s slight retracement

may not last for long as the price would still need to hit the

external high just above the $2,000 region. Moreover, Ethereum’s

trading volume hasn’t made any significant move in the past 7 days.

Still, the range between $12 billion indicated a possible

accumulation which may result in another rally that may happen

soon, given the upcoming Shanghai upgrade set to occur next month.

Interestingly, the asset’s market capitalization has added over $5

billion in the past week, moving from a $207 billion last week to

$212 billion as of today. Featured image from Unsplash, Chart from

TradingView

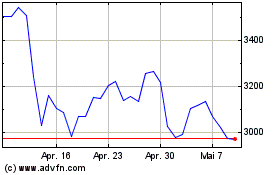

Ethereum (COIN:ETHUSD)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

Ethereum (COIN:ETHUSD)

Historical Stock Chart

Von Apr 2023 bis Apr 2024