Bitcoin Coinbase Premium Continues To Decline, Buying Pressure Ending?

24 März 2023 - 8:00PM

NEWSBTC

Data shows the Bitcoin Coinbase Premium has declined recently,

suggesting that the buying pressure may be slowing down from the US

investors. Bitcoin Coinbase Premium Index Has Gone Down In Recent

Days An analyst in a CryptoQuant post pointed out that the

market may be shifting towards a more balanced sentiment now. The

“Coinbase Premium Index” is an indicator that measures the

percentage difference between the price of Bitcoin listed on the

cryptocurrency exchange Coinbase and that listed on Binance.

Usually, Coinbase receives traffic based heavily in the US, while

Binance has a more global audience. This metric’s value can provide

insight into which demographics buy or sell more of the asset. When

the indicator’s value is positive, the price listed on Coinbase is

currently greater than that on Binance. Such a trend suggests that

American investors may provide more buying pressure (or at least a

lower amount of selling pressure) to BTC than global users. On the

other hand, negative values of the metric imply BTC is selling at a

discount on Coinbase right now, suggesting a relatively higher

amount of selling pressure from the US-based investors. Now, here

is a chart that shows the trend in the Bitcoin Coinbase Premium

Index over the last few months: The value of the metric seems to

have been declining in recent days | Source: CryptoQuant As

displayed in the above graph, the Bitcoin Coinbase Premium Index

had surged to some pretty high values earlier in the month when the

asset’s price had plunged below the $20,000 mark. Related Reading:

Ethereum Bullish Signal: $560M In ETH Exits Exchanges This would

suggest that a hefty amount of buying was taking place from the

US-based investors at those lows. The indicator stayed at these

super-high values until the price sharply increased. The timing of

this can imply that the buying pressure from these holders provided

the fuel for the price to bottom and for the rally to restart.

After the price rapidly increased, the metric’s value began to

drop, meaning that buying was starting to slow down, or just some

fresh selling had started. The Bitcoin Coinbase Premium Index

remained at relatively high positive levels, so the price could

continue its upward trajectory. However, the metric has observed a

further drop in the last week. Related Reading: Quant Explains How

Bitcoin ‘ESR’ Can Act As Leading Indicator For Price The chart

shows that the indicator is still positive, but its magnitude is

much lower. “Interestingly, the current buying pressure is

decreasing, which may signify a shift in sentiment toward a more

balanced market,” explains the quant. The analyst has also attached

the chart for another indicator, the Korea Premium Index, which

measures the difference in the prices listed on South Korean

exchanges and those on foreign ones. Looks like the metric has a

positive value | Source: CryptoQuant This indicator has also been

positive through most of the rally, suggesting Korean investors

have been busy buying. Even now, while the Coinbase Premium Index

has fallen off, this metric hasn’t seen any decline as significant

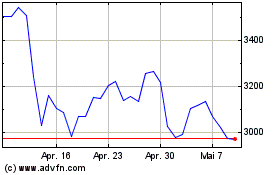

yet. BTC Price At the time of writing, Bitcoin is trading around

$27,900, up 7% in the last week. BTC hasn't moved much in the last

few days | Source: BTCUSD on TradingView Featured image from

Kanchanara on Unsplash.com, charts from TradingView.com,

CryptoQuant.com

Ethereum (COIN:ETHUSD)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

Ethereum (COIN:ETHUSD)

Historical Stock Chart

Von Apr 2023 bis Apr 2024