Why Litecoin Could Be Gearing Up For Its Greatest Rally Since 2017

24 März 2023 - 7:22PM

NEWSBTC

Litecoin price is up 10% this week, and more than 40% since its big

brother Bitcoin began soaring amid the banking crisis. This could

be barely a glimmer of what’s to come, according to a potential

Elliott Wave Principle chart pattern called an expanding ending

diagonal. Keep reading to learn all about this pattern, why LTCUSD

charts look primed for a rally, and why the word “end” is included

in the pattern’s name. Litecoin Prepares For Liftoff As Crypto

Market Recovers Litecoin has fallen from grace since the 2017 bull

market. The cryptocurrency once considered silver to Bitcoin as

digital gold has been more akin to holding a lump of coal. The

altcoin has vastly underperformed Bitcoin, Ethereum, and much of

the market. It’s dropped out of the top ten cryptocurrencies by

market cap in favor of shiny new coins. But all that could change

in a flash, according to an expanding diagonal chart pattern.

Related Reading: This Bullish Bitcoin Technical Signal Suggests The

Bottom Is In An expanding diagonal, in Elliott Wave Principle, is a

broadening pattern with an upward sloping upper resistance trend

line and a less steep upward slowing lower support trend lone.

Price ricochets back and forth between each trend line in

alternating waves of positive growth and correct behavior. If the

pattern is indeed an accurate interpretation of market dynamics,

Litecoin is potentially gearing up for the final and strongest wave

of the pattern. LTC could be ready for its biggest rally in

years | LTCUSD on TradingView.com Why This Could Be The End Of LTC

Growth For A While While the current projection for Litecoin is

bullish, with price targets over $1,400 per coin, the expanding

diagonal typically only forms as a leading or ending pattern.

Leading diagonals typically appear in the wave 1 placement in a

motive wave, or in the wave 5 placement. Since Litecoin has formed

several waves of a larger degree already, the pattern is more than

likely of the ending expanding variant. This could suggest that

after this next, powerful surge in LTCUSD, it could be the last one

for many years. Related Reading: Why The Crypto Market Cycle Could

Be In “Disbelief” Phase Litecoin, like Bitcoin, has several

attributes that make it more like a commodity than a security. In

the stock market, wave 3s are the longest and strongest, while in

commodities markets wave 5s bring the most magnitude. The

particular chart pattern and it’s development could indicate that

the final wave, if this Elliott Wave count is accurate, will be the

greatest and most memorable in years. #Litecoin is gearing up for a

major wave and its biggest move since 2017. Digital Silver could

soon become a narrative. pic.twitter.com/NXT2aZ2BSr — Tony "The

Bull" (@tonythebullBTC) March 23, 2023 Follow @TonyTheBullBTC on

Twitter or join the TonyTradesBTC Telegram for exclusive daily

market insights and technical analysis education. Please note:

Content is educational and should not be considered

investment advice. Featured image from iStockPhoto, Charts from

TradingView.com

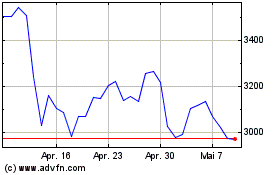

Ethereum (COIN:ETHUSD)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

Ethereum (COIN:ETHUSD)

Historical Stock Chart

Von Apr 2023 bis Apr 2024