On-Chain Data Indicates Ethereum’s Bullish Trend Could Continue

24 März 2023 - 6:00PM

NEWSBTC

Of all the altcoins in the crypto space, the price of Ethereum has

been the one that has closely followed the performance trend of

Bitcoin. The digital asset has been able to clear the $1,800 level

multiple times, dragging more investors into profit. But even more

important is that on-chain data is showing increased adoption for

the cryptocurrency. Ethereum Exchange Withdrawals Reaches 3-Month

High The collapse of FTX triggered massive withdrawals from

centralized exchanges. However, like with any other thing, the

withdrawals had cooled. That is until now when the Ethereum

exchange withdrawals have picked up once again, seeing millions of

ETH removed from exchanges. Related Reading: New Proposal Wants To

Burn All Coins In LUNC Oracle Pool, Will This Help The Price?

On-chain data aggregator Glassnode reported that the amount of ETH

being withdrawn from centralized exchanges on a seven-day moving

average hit a new three-month high of 3,134.065 ETH. The last time

withdrawals were this high was back in late 2022 and the following

weeks saw the price of the digital asset climb steadily, as shown

in the chart below. ETH exchange withdrawals reach 3-month highs |

Source: Glassnode Adoption is also not left behind as the network

has seen an uptick in the number of new addresses created. This

metric also recovered to a three-month high as new ETH addresses

climbed as well. Importantly, the Arbitrum (ARB) airdrop spurred

adoption on the blockchain as many rushed to take advantage of the

new liquidity. ETH Profitability Climbs Again With Ethereum’s price

tethering between the $1,700 and $1,800 level, a large portion of

investors has now moved into the profit territory. Data from

IntoTheBlock shows that a total of 66% of wallets holding ETH are

seeing profit as the coins were purchased at lower than the current

price. This has pushed down the percentage of those seeing losses

to 32% with 3% sitting in the neutral territory (meaning they

bought at the same price the coin is now trading for). E Glassnode

corroborates this with its report that the number of ETH addresses

in profit has reached an 11-month high. At the time of the report,

a total of 63,933,355.435 wallets are all in the green. The last

time it was this high was at the beginning of the second quarter of

2022. Related Reading: XRP, ADA Lead Market Rally With Double-Digit

Gains, More Upside To Come? These metrics growing so fast in such a

short time point to a largely bullish outlook among investors. This

increased positivity in the market can easily translate to better

price action for the digital asset and could be the push it needs

to finally scale the $2,000 hurdle once and for all. At the time of

writing, Ethereum is changing hands at $1,790, up 2.26% in the last

day. It is seeing meager gains on the weekly chart after rising

only 2.44% in the last week. Follow Best Owie on Twitter for market

insights, updates, and the occasional funny tweet… Featured image

from iStock, chart from TradingView.com

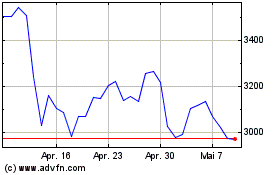

Ethereum (COIN:ETHUSD)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

Ethereum (COIN:ETHUSD)

Historical Stock Chart

Von Apr 2023 bis Apr 2024