Bitcoin Mining Difficulty Touches New ATH Following 4.68% Adjustment

30 Januar 2023 - 1:00PM

NEWSBTC

The bitcoin mining difficulty has once again clocked a new all-time

high. This adjustment is one of the largest positive adjustments so

far for the year, and with the new ATH comes a brand new set of

implications for the digital asset. Bitcoin Mining Difficulty

Reaches New High On Sunday, January 29, the bitcoin mining

difficulty underwent a 4.68% adjustment that saw the difficulty

shoot up. It took place at block 774,308 and the difficulty is now

currently sitting at 39.35 terahash per second on a seven-day

basis. Related Reading: Here’s What Might Have Triggered Ethereum’s

Decline Below $1,600 This adjustment puts the difficulty above its

previous high of 37.59 TH/s which was recorded on January 16th. The

next difficulty adjustment is expected to take place on February

11. Forecasts for the next adjustment are set at an upward 3.63%

which would put the difficulty at a new all-time high. BTC

difficulty adjusts to 39.35T | Source: CoinWarz Over the last 30

days alone, the bitcoin mining difficulty is already up more than

11.27% as 2023 starts off on a high note. It also shows that more

miners are plugging back into the network, hence the high

adjustments being recorded. Nevertheless, the competition is good

for the digital asset as not only do more miners on the network

help to secure it, but more rigs coming online means a high level

of demand for the digital asset. BTC is now much harder to mine so

miners will have to increase their hashrate to be able to

efficiently mine the same volume as they used to. Will This Affect

The BTC Price? Over the last day, the bitcoin price has already

seen a drawdown following the difficulty adjustment. This comes as

no surprise as there was ample resistance at the $24,000 level and

the adjustment only helped to put more selling pressure on the

coin. However, the digital asset continues to hold above the

$23,000 price level which is great because this ensures that BTC

remains above its 100-day and 200-day moving averages. As long as

both of these levels hold, the price of BTC still remains firmly in

a bullish trend. Related Reading: U.S. Institutions Are

Driving Bitcoin Prices, Matrixport Research As long as the price of

BTC is also on the high side, miners will not be putting as much

selling pressure on the market. They will have to sell fewer tokens

in order to keep their operations going, as well as be able to hold

a higher percentage of their mined coins. In the end, there is not

much supporting evidence that the mini-bull rally is over but that

remains to be seen. At the time of writing, BTC is changing hands

at a price of $23,356, up 1.58% in the last seven days. BTC price

falls to $23,200 in face of higher mining difficulty | Source:

BTCUSD on TradingView.com Follow Best Owie on Twitter for market

insights, updates, and the occasional funny tweet… Featured image

from CoinDesk, chart from TradingView.com

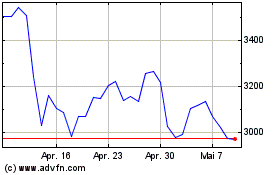

Ethereum (COIN:ETHUSD)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

Ethereum (COIN:ETHUSD)

Historical Stock Chart

Von Apr 2023 bis Apr 2024