AAVE Seeks Proposal To Clear Itself Of Bad Debt – Can It Overcome These Obstacles?

29 Januar 2023 - 11:33AM

NEWSBTC

The lending platform AAVE has been enjoying positive news lately.

According to reports, AAVE has passed a governance proposal that

would eradicate all bad debt it accumulated when Avraham Eisenberg,

orchestrator of the Mango Markets exploit, targeted the platform’s

Ethereum V2 liquidity pool back in November 2022. However,

the governance token of the platform, AAVE, has not responded

either positively or negatively. According to data from CoinGecko,

the token registered losses in the daily and weekly time frames.

But these losses are too miniscule to revert the token’s gains from

the start of the year. With the launch of AAVE’s V3 on

its mainnet, the crypto might be in a position to tally new highs

if the situation permits it. Image: Coinpedia The Gist Of The

Proposal & On-Chain Developments Based on the proposal, the

token has over 2,677,749 units of CRV in debt on its Ethereum V2

CRV reserve. This is worth, at the date of the proposal, over $2.5

million. The proposal would use V2’s stablecoin reserve to buy the

necessary number of units of CRV to pay the debt. This obviously

was accepted by the community positively, being implemented

immediately by January 25th. This would reverse the damage of the

exploit attempt, proving the liquidity of the protocol. The

deployment of AAVE’s V3 on Ethereum was also implemented. According

to DefiLlama, the crypto is in the top 4 among all platforms. AAVE

V3, the Ethereum pool deployment, has over $526.52 million total

value locked. Image: DefiLlama At $86.02, What’s In Store For

AAVE? The token is currently consolidating around the $85.8

support range. This could be a sign that the token still has room

to regain lost ground from 2022’s bear market. However, this can

only be achieved if the token closes with a green candle to

continue AAVE’s rally when the year started. Investors and

traders should target the token’s current resistance at $90.15. If

the bulls can consolidate at the token’s present support, we can

see an upward push towards $94.70. Related Reading: Dogecoin

Ascent Slows, But Why Are Analysts Still Bullish About The

Memecoin? AAVE total market cap at $1.2 billion on the daily chart

| Chart: TradingView.com Related Reading: What Is Threshold (T) And

Why Is This Lesser-Known Coin Swelling By 146%? Investors should

also monitor the token’s correlation with Bitcoin and Ethereum as

these would have a big influence on its price movement in the short

to medium term. As these major cryptocurrencies retest their

crucial resistances, a breakthrough by either one or both of these

coins would boost AAVE’s momentum to regain lost ground. With

this in mind, investors and traders should exercise caution in the

short to medium term as the token can still be clawed by the bears

to revert back to $78.65. Featured image by Kanalcoin.com

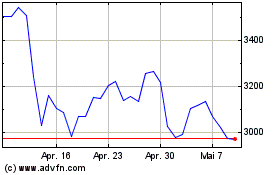

Ethereum (COIN:ETHUSD)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

Ethereum (COIN:ETHUSD)

Historical Stock Chart

Von Apr 2023 bis Apr 2024