The Pelosi Effect? Ethereum Faces Headwinds Over Area At $1,600

04 August 2022 - 8:00PM

NEWSBTC

Ethereum has lost steam after a week of trading in profits. The

elements for a potential extension of the bullish momentum were

laid out in the macro-economic stage. Still, rising tensions

between China and the United States have brought back uncertainty

to the global financial world. Related Reading: TA: Solana

Struggles To Break Key Resistance After $5M Hack U.S. Congresswoman

and Speaker of the House of Representatives Nancy Pelosi visited

Taiwan earlier this week. Her visit is controversial, as Taiwan is

considered a territory in open rebellion by China. The latter

responded to Pelosi’s visit by firing artillery near Taiwan and

announcing military exercises, the Asian giant considers this an

“act of provocation”. So, tensions about a potential conflict

between the U.S., Taiwan, and China in the near future emerged.

Investment firm Cumberland believes the above highlights the tight

correlation between Ethereum, the crypto market, and the

traditional finance sector. The second crypto by market cap has

been trending downside in the short term as a result of this

uncertainty. Ethereum and Bitcoin have been highly correlated with

the Nasdaq 100, the index that tracks big tech stocks. Cumberland

believes that if ETH’s price can break this correlation, the

cryptocurrency will be able to reclaim previous highs. Until then,

ETH’s bullish momentum seems limited. The investment firm said the

following on ETH’s price fate as long as it remains correlated with

legacy markets: Until crypto decorrelates from the broader macro

backdrop, it will be difficult for these themes to generate

meaningful alpha. That said, the upcoming merge threatens to

reestablish digital asset markets as an independent asset class.

The Merge is the highly anticipated event that will combine

Ethereum’s execution layer with its consensus layer. This event

might be important enough to provide bulls with fresh momentum and

break the correlation with the Nasdaq 100. Before The Merge,

Ethereum Ecosystem Outperforms The Merge is already having a

positive impact across the Ethereum ecosystem, and on the other two

assets, Lido DAO and Ethereum Classic (ETC). A report from Kraken

Intelligence shows that the ETH ecosystem has and continues to

outperform the crypto market. Related Reading: Binance Coin Finds

Support At $240 – Can BNB Barrel Past $300? In July, ETH’s price,

decentralized finance (DeFi) and non-fungible tokens (NFTs)

recorded an average of 59%, 52%, and 35% profits respectively.

Thomas Perfumo, Head of Business Operations and Strategy at Kraken,

said the following on the potential impact of The Merge: ETH is

holding value during this crypto winter against BTC, a significant

departure from the prior cycle. All eyes are on The Merge, the most

significant milestone to Ethereum’s scaling roadmap since the

launch of the beacon chain in late-2020. If successful, the

industry will have the clarity to take a longer-term outlook on

Ethereum.

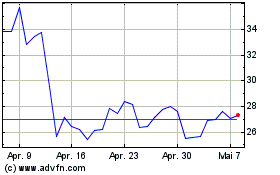

Ethereum Classic (COIN:ETCUSD)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

Ethereum Classic (COIN:ETCUSD)

Historical Stock Chart

Von Apr 2023 bis Apr 2024