Bitcoin Miner Revenues Continue To Plunge, But Will The Rally Change This?

21 Juli 2022 - 7:00PM

NEWSBTC

Bitcoin miner revenues have been plummeting ever since the price of

BTC peaked back in November. This has put miners in a tight spot,

causing a good number of them to sell their BTC holdings in order

to keep financing their operations. The same was the case for last

week, where miner revenues were once again in the red. However, as

the tide begins to change in the crypto market, there may be light

at the end of the tunnel for miners. Miner Revenues Down 4% For the

past month, daily miner revenues have been trending above $18

million but continued recording losses with each passing week. Last

week would put an end to this trend when miner revenue fell once

again, this time by 4.03%, causing average daily revenues to drop

below $18 million. Reports show that miners saw an average of $17.7

million in revenues, more than 60% down from its peak back in

November. Related Reading | Ethereum Classic (ETC) Reclaims $3

Billion Market Cap, More Upside To Follow? What followed this was a

sell-off from bitcoin miners across the space. As the profitability

plummeted, more BTC had to be offloaded by miners to provide cash

flow for their operations. In June alone, miners had sold off 25%

of their holdings, and with the prices remaining low, reports for

July are expected to show even higher sales for the month of July.

For the last two months, bitcoin miners have been selling more BTC

than they were producing. For the month of May, they had sold more

than 100% of the BTC produced. This number had jumped 400% in June

when public miners sold approximately 14,600 BTC when they had only

produced a total of 3,900 BTC, accounting for 25% of all of their

holdings. BTC drops to $22,700 | Source: BTCUSD on TradingView.com

Surprisingly, fees per day were up 12.61% last week, which brought

the percentage of revenue gotten from fees to 2.59%, a 0.38%

increase from the prior week. Will The Bitcoin Rally Help? The

recent rally in the market has seen the price of bitcoin reclaim

key technical levels and reach one-month highs. The digital asset

had even briefly touched above $24,000 before trending back down,

and the first half of the week had been green for the digital

asset. Related Reading | Why Bitcoin Must Beat $25,500 To

Establish A Bull Rally Since the profitability of bitcoin mining is

directly tied to the price of the digital asset, it is safe to

assume that there may be some uptick in miner revenues for this

week. Given that price was trending around $19,000 for most of last

week, an increase above $22,000 will see public bitcoin miners

realize more revenue from their mining operations. However, given

that the price had not recovered by a wide margin, the rise in

daily miner revenue is expected to remain under double-digits. It

is also important to note that there is more demand for block

space, leading to higher transaction fees on the network,

contributing more to the daily miner revenues. Featured image from

GoBankingRates, chart from TradingView.com Follow Best Owie on

Twitter for market insights, updates, and the occasional funny

tweet…

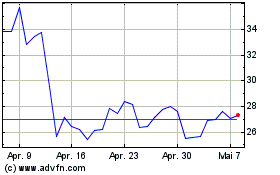

Ethereum Classic (COIN:ETCUSD)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

Ethereum Classic (COIN:ETCUSD)

Historical Stock Chart

Von Apr 2023 bis Apr 2024