Bitcoin Activity Soars Post SWIFT Ban On Russia, BTC At Do Or Die Spot?

05 März 2022 - 7:00PM

NEWSBTC

Bitcoin has found temporal support at $39,000, but buyers have been

scarce as the market enters into weekend price action. Uncertainty

around macro factors seems to be growing with the Russia-Ukraine

conflict contributing with the selling pressure experience by BTC

and larger cryptocurrencies over the past days. Related Reading |

Market Update: Crypto Market Rebounds As Tech firms Boycott Russia

At the time of writing, Bitcoin trades at $39,168 with a 4.2% loss

in the past 24 hours. The benchmark crypto saw some relief before

the current downside action. Per a report from research firm Delphi

Digital, Bitcoin activity boomed due to consequences of the Russian

invasion of Ukraine. The United States, Europe, and the

International Community decided to ban the Russian Federation from

the Society for Worldwide Interbank Financial Telecommunication

(SWIFT), the communication rails used by banks in the legacy

financial system. Effectively, making Russia a financial outsider.

As seen below, on March 1st, when the sanctions were announced,

Bitcoin’s active supply saw it largest surged since May 2020. At

that time, the start of the lockdown measures to prevent the spread

of COVID-19 led global markets into a severe downtrend. This uptick

in Bitcoin active supply could suggest buyers increased their

holdings to hedge against future events. At the same time, as

reported by Brian Armstrong and other crypto exchange CEOs, BTC and

other cryptocurrencies have been used by people on the ground to

safely transport wealth across borders. Additional data provided by

Delphi Digital seems to support this thesis as the BTC supply held

by addresses with balances between 0.001 and 10 BTC stood above

2.73 million. The research firm added the following: Cutting off

the Russian Ruble from the world’s financial system led to a

sell-off, causing it to drop 20% over the weekend. As

Russians try to preserve value, BTC has emerged as one of the

options. This caused BTC to trade at an eye-popping 40% premium.

Bitcoin At Make It Or Break It Moment? As NewsBTC reported

yesterday, Bitcoin needed to hold above $40,000 to prevent further

downside. Now, with critical support lost, a potential revisit of

$36,000 seems likely. Data from Material Indicators seems to

support this thesis, at least for lower timeframes, as there seems

to be low liquidity at current levels at up to that price point. As

seen in the chart below, there are around $18 million in bids

orders for BTC at $36,000. Until that point, any levels seem weak,

for the short term. To the upside, the order book seems equally

thin, but without buying pressure it seems unlikely that BTC’s

price will make a push upwards, for the time being. Related Reading

| Billionaire Investor Says Crypto Outlook Is ‘Very Bullish’ For

Bitcoin According to a pseudonym analyst, BTC’s price benefited

from the “safe haven asset narrative”, but that momentum seems to

have been extinguished. Talking about the potential opportunity to

buy BTC’s dip into future lows, giving the asset’s possible

capacity to reclaim previous highs, the analyst said: (…) we’d need

a push above $46K to continue it’s bullish trend which won’t be

easy either after such a fall (…). As for $BTC’s direction I’m a

bit conflicted on what’s next. Until we lose the current level I

still have some hope for a reversal but the bulls really have to

pull through after the weekend. As for the weekend I expect mostly

chop as usual.

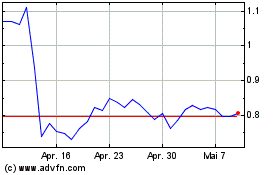

EOS (COIN:EOSUSD)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

EOS (COIN:EOSUSD)

Historical Stock Chart

Von Apr 2023 bis Apr 2024