BTC Reclaims Its 20K Spot After A Couple Of Bloody Weeks

28 September 2022 - 12:22AM

NEWSBTC

After plummeting to significant lows in July, bitcoin has been

locked in a sideways trading action angling towards higher prices.

Still, investors are anxious to see what’s going to happen

next. Last week, the Federal Reserve’s decision to squeeze

more US Dollars out of circulation with another interest rate hike

sent BTC tumbling. After finding support at the $18,000

psychological level, BTC surged 7% on the 27th of September in a

tremendous display of volatility. As a result, the number one

digital asset recovered to trading above $20,000 for the first time

in over a week. Related Reading: Bitcoin 90-Day CDD Hits

All-Time Low, What Does It Say About Market? Differed Opinions on

BTC’s Volatile Tuesday Run TradingView tracked the movement

of BTC as it closed in the green by 7% on the 26th of September.

Data from Bitstamp reported a price peak at $20,344 before it

eventually settled at $20,200. As expected, the move seized

the attention of many traders in the crypto bubble. However, people

gave bipolar reactions to the news. Other comments warned investors

to avoid making hasty, late entries influenced by the fear of

missing out. Analysis from a user with a strong crypto

presence on Twitter dismissed any hope of a market reversal just

yet. Capo of Crypto believes there would be lower lows below

$19,000 before we see any relief from the crypto winter. Will

The Bulls Run The Bears Out Of The Market This Month? BTC’s

aggressive gains made September’s last Tuesday an eventful day in

the crypto world. Besides users giving their varied points of view

on the likely interpretation of the recent move, several crypto

research firms cannot wait to jump in and give their

perspectives. According to an on-chain analysis from

Santient, the future of BTC’s price rests in the hands of the

bulls. If they defend the $20,000 position till Friday, cementing

September with a green close, a bright future awaits BTC price

action. The crypto market data and analytics platform,

Santient, also noticed a lot of users taking profits as soon as BTC

crossed the $20,000 key level. It seems several traders set

automatic and mentally-noted take profit signals at that mark.

Santient also divulged a transaction log of users claiming profits

and closing losses at the same price. How September’s Ending Might

Define The Future Direction of Crypto Based on a tweet by Santient,

reclaiming the $20,000 spot increases the odds of BTC closing

higher than its starting point in September. And more importantly,

finishing past this psychological level will have a hugely positive

effect on investors’ sentiment. September has been a slow month for

the world-leading crypto. Despite the 7% gains on the 27th of

September, bitcoin is currently making moderate monthly gains of

0.7%. That’s a heavy contrast to the day before, which left bitcoin

trailing at a 6% loss according to monthly P&L data by

CoinGlass. Related Reading: Ethereum Name Service (ENS) Looks

Strong, Eyes $16 Reclaim However, it is pivotal that BTC finishes

above its September starting point, no matter how little the gains.

BTC will record its first “September green” month since 2016 to

finish this month in profit. As of writing, bitcoin has

slightly slipped below $20,000 to trade around $19,150. Featured

image from Pixabay and chart from TradingView.com

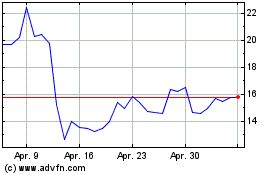

Ethereum Name Service (COIN:ENSUSD)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

Ethereum Name Service (COIN:ENSUSD)

Historical Stock Chart

Von Apr 2023 bis Apr 2024