Ethereum Price Squeezes Shorts Positions, ETH Could Be Set For More Gains

03 Oktober 2022 - 9:48PM

NEWSBTC

Ethereum is following the general sentiment in the market as

Bitcoin and other cryptocurrencies make a run towards previous

highs. The second cryptocurrency by market cap knocked some gains

over today’s trading session but seems poised for a re-test of its

lows before moving to the upside. Related Reading: LUNC Price Gains

50% Despite Kwon’s Troubles, What’s Driving It? At the time of

writing, Ethereum (ETH) trades at $1,300 with a 2% profit in the

last 24 hours and in the last week. Unlike in previous rallies,

ETH’s price is lagging larger cryptocurrencies, such as Bitcoin,

the number one crypto that records a 4% profit over the same

period. Ethereum At Critical Point, Will It Finally Breakout?

Today’s bullish price action seems to be prompted by a rebound

across legacy financial markets, the S&P 500 and Nasdaq 100

have been trading in the green giving cryptocurrencies room for a

run. The bullish price action is leading to a change of sentiment

across the digital asset class as investors turned optimistic. Over

the weekend, with traditional markets close, the situation was

different and market participants were gearing up for a potential

leg down. According to a pseudonym trader, Ethereum saw a spike in

Open Interest (OI) against the U.S. dollars. This increase in OI

was recorded as the cryptocurrency trended to the downside.

Therefore, the analyst claims that the metrics hinted at a spike in

short (sell) positions from traders expecting further downside in

the short term. The liquidity provided by these short positions

accumulates to the upside, making each rally stronger and fueling

further bullish momentum. However, the analyst believes the market

might take this upside liquidity before re-testing support levels.

The pseudonym trader wrote the following via his official Twitter

account: I said yesterday that there was a lot of short build up on

$ETH. They’re getting squeezed now. Once that’s done it gets

slapped back down I think. Looks like a clean short set-up. Related

Reading: Quant Explains How US Stock Market Volumes Influence

Bitcoin Price In case of potential downside, data from Material

Indicators shows that the area between $1,280 and $1,250 has the

biggest concentration of bid (buy) liquidity on low timeframes.

These levels might provide the bulls with strong support to either

resume the bullish momentum or send ETH back into accumulation

mode.

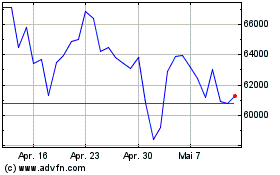

Bitcoin (COIN:BTCUSD)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

Bitcoin (COIN:BTCUSD)

Historical Stock Chart

Von Apr 2023 bis Apr 2024