Bitcoin Monthly Tags Lower Bollinger Band, Tool’s Creator Hints At Bottom

27 Juni 2022 - 11:11PM

NEWSBTC

Bitcoin price action on monthly timeframes has made a historic move

to the touch the lower Bollinger Band – a popular technical

indicator and volatility measuring tool. Although he warns there

isn’t yet a sign that a bottom is in, the tool’s creator says where

price action tapped is a “logical” level for such a bottom to

occur. Unprecedented Bitcoin Price Action Taps Monthly Bollinger

Band For First Time In History Expectations for Bitcoin price in

2022 were closer to $100,000 per coin and above. Yet the top

cryptocurrency today is trading close to its former 2017 all-time

high at $20,000. But unprecedented macro conditions has caused

unprecedented price action in Bitcoin and other cryptocurrencies.

Never in the past has the top cryptocurrency by market cap retested

its former all-time high this way. Related Reading | Bitcoin Weekly

RSI Sets Record For Most Oversold In History, What Comes Next? And

never did Bitcoin price on monthly timeframes ever reach the lower

Bollinger Band. But that’s exactly what happened this past month

when crypto market contagion spread and brought asset prices down

considerably. BTCUSD monthly touches down on the lower Bollinger

Band | Source: BTCUSD on TradingView.com Touching the lower

Bollinger Band, however, could be a logical place for a bottom

according to the tool’s creator. Time To Pay Attention: John

Bollinger Points Out Logical Level For Potential Bottom The

Bollinger Bands are a technical analysis tool that can help to

measure and predict volatility, or find areas of potential

resistance and support. It was created in the 1980s by John

Bollinger, who today is a frequent Bitcoin speculator. It relies on

a 20-period simple moving average and a dynamic upper and lower

band set each at two standard deviations. Mr. Bollinger pointed out

the touch of the lower Bollinger Band in a new tweet, where he

suggests the area would be a “logical” level to bottom. Bollinger

did warn, however, that there still aren’t signs of such bottoming

yet. In the past, Bollinger was able to call out the April 2021

peak by spotting a “three pushes to a high” bearish reversal

pattern with striking accuracy. The analyst says his tools later

confirmed what he says was an “M-type” double top. Picture perfect

double (M-type) top in BTCUSD on the monthly chart complete with

confirmation by BandWidth and %b leads to a tag of the lower

Bollinger Band. No sign of one yet, but this would be a logical

place to put in a bottom.https://t.co/KsDyQsCO1F — John Bollinger

(@bbands) June 27, 2022 Bollinger also shared in his chart a look

at ancillary indicator, B%, which also has set historical lows.

Monthly Bollinger Band Width can be used to measure volatility, and

still has room to fall compared to past cycles. Related Reading |

Is Bitcoin Like Buying Google Early? Check Out The Shocking

Comparison Does Bitcoin price have more room to fall also? Or will

a bottom form in this “logical” zone as the tool’s creator calls

attention to? Either way, it seems to be “time to pay attention.”

Follow @TonySpilotroBTC on Twitter or join the TonyTradesBTC

Telegram for exclusive daily market insights and technical analysis

education. Please note: Content is educational and should not

be considered investment advice. Featured image from

iStockPhoto, Charts from TradingView.com

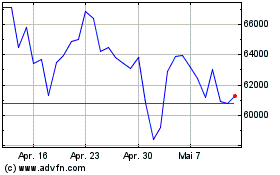

Bitcoin (COIN:BTCUSD)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

Bitcoin (COIN:BTCUSD)

Historical Stock Chart

Von Apr 2023 bis Apr 2024