El Salvador Buys 410 More Bitcoins In Recent Dip

25 Januar 2022 - 5:00PM

NEWSBTC

El Salvador President Nayib Bukele announced that the Central

American country purchased 410 more Bitcoins in a recent market

dip. The announcement came days after his administration revealed

its intentions to invest significant funds into cryptocurrency

mining operations. Amid market drop, El Salvador purchases 410 more

bitcoins. President Bukele says the nation now has over 1,800 BTC

and plans to issue a $1 billion 10-year bitcoin bond this year. El

Salvador is the first country to adopt bitcoin as legal tender, and

we have seen great results so far. The country’s central bank

reported that it had bought at least 1,391 Bitcoin before the

Friday dip. El Salvador has a new plan to make it the crypto-mining

capital of Central America. With plans for an entire city focused

on cryptocurrencies and tax breaks available only if you’re born

there or invest money into blockchain projects, this country is

quickly becoming one worth keeping your eye upon. Salvadoran

President Bukele believes that if bitcoin becomes an integral part

of their country’s economy, it would be curtains for FIAT. Bukele’s

Tweets On Buying 410 Bitcoins Bukele’s first tweet was on Jan 14,

2022, “I think I might have missed the dip this time.” In reply to

that tweet, Bukele added, “Nope, I was wrong, didn’t miss it.” He

also added, “El Salvador just bought 410 #bitcoin for only 15

million dollars.” The tweet quickly became an online

sensation and gathered over 20,000 likes in just one hour.

Additionally, EI Salvador president Bukele mentioned in his tweet,

“Some guys are selling really cheap.” Was It Worthy Adopting

Bitcoin As National Currency? Bukele’s decision to make El Salvador

the first Latin American country with a legal cryptocurrency

sparked substantial controversy. The implementation of bitcoin as a

national currency has been met by violent resistance from citizens.

People believe that it will only benefit large investors rather

than everyday people. The El Salvador national debt is at an

all-time high, with over 50% of the GDP in July. As a result,

Moody’s has downgraded their credit rating to Caa1. This marks

precarious investment opportunities. People choose not to invest in

the country because they want peace of mind regarding currency

stability and risk mitigation against unexpected events. A recent

report shows that El Salvador is seeking help to the tune of $1.3

billion from The International Monetary Fund. The country asked for

help after adopting Bitcoin into its legal tender system. However,

IMF already warned the Government not to adopt Bitcoin as a

currency. Featured image from Pixabay, chart from TradingView.com

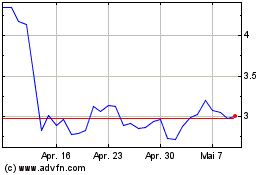

BOND (COIN:BONDDUSD)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

BOND (COIN:BONDDUSD)

Historical Stock Chart

Von Apr 2023 bis Apr 2024

Echtzeit-Nachrichten über BOND (Cryptocurrency): 0 Nachrichtenartikel

Weitere BOND News-Artikel