MATIC Price Retraces But Buyers Can Re-Enter At This Level

21 Februar 2023 - 7:00PM

NEWSBTC

The MATIC price has shown a significant recovery over the past few

weeks. At press time, however, the bulls seem to have lost vigor.

Over the last 24 hours, MATIC dipped over 4%. On the other hand, in

the previous week, the altcoin surged over 19%. This helped the

coin break past important resistance lines. However, the altcoin’s

technical outlook maintained a bullish stance on the one-day chart.

Although there was a slight fall in demand and accumulation, buyers

remained in the positive zone. Related Reading: BLUR Token Clears

The Path With 67% Rally In Single Week If the demand for MATIC does

not drop, the altcoin price could be expected to turn around. With

Bitcoin falling below the $25,000 price, many prominent altcoins

have been stuck underneath their immediate resistance levels.

Polygon (MATIC) is trading 52% below its all-time high secured in

2021. Some altcoins, Polygon included, were also depreciating on

their respective charts. Although the bulls have not entirely

faded, another price pullback will cause MATIC to fall into the

clutches of the bears. MATIC Price Analysis: One-Day Chart Polygon

(MATIC) was exchanging hands at $1.41. Over the past week, MATIC

has pushed above many price ceilings. In that same period, the

altcoin reached the $1.52 price mark, but the bulls could not

sustain the price momentum. The immediate resistance for the coin

stood at $1.47; if Polygon manages to trade above that level for a

considerable time, then it will be an easy way to $1.57.

Conversely, another pullback will bring MATIC down to $1.25 and

then $1.16. Moving close to the $1.25 price mark will reflect

bearishness on the chart. The amount of Polygon traded in the last

session was red, which meant a fall in the number of buyers.

Technical Analysis The altcoin was rejected from the $1.52 price

mark, which has caused it to move down from the overvalued zone.

Despite a downtick, the Relative Strength Index was still above the

60 mark; this reading meant that the buyers dominated the market.

Polygon price remained above the 20-Simpdropoving Average (SMA),

indicating buyers were still driving the price momentum. If demand

falls slightly, the coin will fall to $1.30, which could present a

buying opportunity for traders. A fall to $1.30 can push MATIC up

to $1.60. The altcoin formed declining buy signals as the demand

for the altcoin fell slightly on the daily chart. The Moving

Average Convergence Divergence, which indicates price momentum and

trend reversal, was forming smaller green signal bars. Related

Reading: XRP Whale Moves $19.7 Million Away From Binance, Bullish

Sign? These signal bars were tied to declining buy signals for the

altcoin. The Bollinger Bands suggest price volatility and

fluctuation; the bands opened up wide, increasing incoming

volatility on the chart. Featured Image From UnSplash, Charts From

TradingView.com

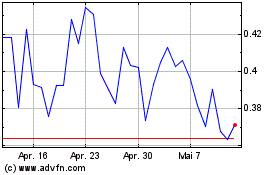

Blur (COIN:BLURUSD)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

Blur (COIN:BLURUSD)

Historical Stock Chart

Von Apr 2023 bis Apr 2024