Bitcoin And Crypto Are Rising Today, Here’s Why

18 April 2023 - 1:10PM

NEWSBTC

The Bitcoin price remains the all-determining trend setter for the

crypto market. After the Bitcoin price fell to as low as $29,173

yesterday, dragging all altcoins down with it, the crypto market is

back in the green across the board today. At press time, the

Bitcoin price has once again climbed above the key resistance level

of $29,800. This means that BTC has gained 2.7% since yesterday’s

low and was trading back above $29,900. Altcoins such as Arbitrum

(ARB), Chainlink (LINK) and Avalanche (AVAX) are recording sharp

price gains, dwarfing the Bitcoin uptrend. Here’s Why Bitcoin And

Crypto Are Up Today As NewsBTC reported, yesterday’s correction in

the Bitcoin price can be seen as a technical consolidation. In

particular, the medium-term macroeconomic outlook continues to

argue that both Bitcoin and the entire crypto market will see a

continuation of their rally. An impetus for today’s rally may have

been provided by the macro data from China, among other things. As

announced in the morning hours today, China’s economy grew by 4.5%

in the first quarter of 2023, the fastest pace in a year. Related

Reading: Not So Fast: Bitcoin Strength Fails To Breach This Key

Bullish Level Moreover, the increase was steeper than expected, as

the end of “Zero COVID” led to a surge in consumer spending and

factory output. All data were positive across the board. Gross

Domestic Product (GDP) (YoY) came in at 4.5% in Q1 2023, up from

4.0% estimate. Retail sales rose to 10.6% in March (YoY), versus

7.4% estimate. The unemployment rate was 5.3% versus 5.5%

(estimate). Overall, strong Macro data from #china 📢 🇨🇳 Industrial

Production (YoY) (Mar) came in at 3.9% Vs. 4.0% Est. 🇨🇳 GDP (YoY)

(Q1) came in at 4.5% Vs. 4.0% Est. 🇨🇳 Retail Sales (YoY) (Mar) came

in at 10.6% Vs. 7.4% Est. 🇨🇳 Unemployment Rate came in at 5.3% Vs.

5.5% Est.#GDP https://t.co/4btei6LudT — BACH (@MortensenBach) April

18, 2023 The US dollar index (DXY) is also likely to have provided

additional impetus. Bitcoin and the DXY are inversely correlated,

which means that the cryptocurrency usually rises when the DXY

falls. The DXY has come under heavy pressure in recent weeks, but

has experienced a minor relief rally since Friday, pushing the

index up from 100,807 to 102,207. Now today, the DXY is showing a

renewed weakness, plunging to 101,603. What’s Next For Bitcoin And

The DXY? With this in mind, Glassnode co-founders Jan Happel and

Yann Allemann call Bitcoin’s current move a “shallow correction,”

which is the hallmark of a strong bull market rally. The analysts

argue that there was a possibility of a potential pullback to

$25,000. Related Reading: Company Of Legendary Peter Brandt Goes

Long Bitcoin, Here’s His Target Price However, this has not

materialized as Bitcoin has risen to $30k in a matter of days.

“This is a very clear signal of the strength of momentum and higher

prices are expected,” write Happel and Allemann, who add: We have

pointed out $35k as the next major target – before $47k. This is

still the outlook just as we expect much higher prices into late Q2

and Q3. But we still need to ask the question of the possible

consequence for bitcoin if/when DXY moves to 105-107. The two

analysts expect the DXY to reach the 91-93 range before the end of

the year. However, based on the Elliott wave theory, they do expect

a bounce to the upside first: We expect DXY to reach 105.8 or

perhaps 107.2 – before rolling strongly over. A convincing decline

below 100 would seriously question this setup. Featured image from

iStock, chart from TradingView.com

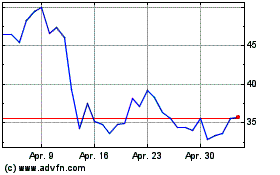

Avalanche (COIN:AVAXUSD)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

Avalanche (COIN:AVAXUSD)

Historical Stock Chart

Von Apr 2023 bis Apr 2024