Crypto Firms Should Ditch Banks To De-risk From Volatile Systems, Says Cardano Founder

15 März 2023 - 1:30PM

NEWSBTC

Some crypto-friendly top banks have crashed due to regulatory

uncertainty, market downtrend, and shortage of operational funds.

The three banks that sent the digital asset market into a downtrend

were Silvergate, Silicon Valley, and Signature bank. These banks

serviced top firms such as Paxos, Coinbase, Yuga Labs, Circle,

Panterra Capital, and Avalanche. Related Reading: USDC Feeling

Intense Pressure Despite Fed Action To Halt SVB Contagion The

sudden crash exposed these crypto firms to risks leading to a

bearish trend in the crypto market. Notably, the trend changed when

the US Federal Reserve announced support funding to protect

depositors of the shuttered bank. This incident has propelled

Cardano founder, Charles Hoskinson, to propose that the crypto

industry ditch the banks. Banks Are Volatile And Unstable,

Cardano Founder Charles Hoskinson’s tweet reflected his

thoughts on the ongoing crisis in the banking sector. In his

message, the Cardano founder stated that the banks are unstable and

that the industry should reconsider using them. While

responding to Hoskinson’s tweet, a user named Crypto Dojo agreed to

his suggestion, pointing out that the industry needed a

decentralized digital asset bank. In response, Hoskinson stated

that the banks wouldn’t matter once the industry digitalized

treasuries. Other Twitter users supported Hoskinson’s idea of

ditching banks. One Twitter user who goes by KG pointed out that

the US Dollar de-pegged from the gold standard to become a

standalone medium of exchange. As such, the digital sector needs to

de-peg from USD and become a “self-sustaining and perpetuating

ecosystem.” Still, on Hoskinson’s post, another user

suggested that Bitcoin should also distance itself from many

unstable coins and tokens to align with other positive projects

pursuing a better tomorrow. Implications Of Bank Implosions

On The Crypto Sector The three banks that crashed recently were

crypto-friendly institutions. By going out of business, they have

exposed many crypto firms to a desperate search for suitable

institutions to support their operations. Moreover, it will take

time for the industry to reestablish a solid connection with the

traditional banking system. Related Reading: Bitcoin Price Explodes

10% In 24 Hours With A Breach Of The $24,000 Level In the past, it

was very challenging for some crypto firms to gain the support of

banks. Now, the situation is replaying once again. Some crypto

companies even suspended USD bank transfers due to the

disconnection of banking support. With the current situation,

Hoskinson’s suggestion may not seem farfetched, given that some

people blamed the crypto industry for the collapse of these banks.

Even though it may not be true, shutting down these banks suggests

increased regulatory scrutiny on the financial industry, including

crypto. It also shows that the crypto industry is seen as a huge

threat to the traditional finance system due to its decentralized

nature. Many supporters of the crypto industry have envisaged

a time when it will overtake the traditional finance system. While

such a day remains a futuristic reality, the industry has to

struggle to reconnect to the banking system to continue running

smoothly. Featured image from Pixabay and chart from

Tradingview.com

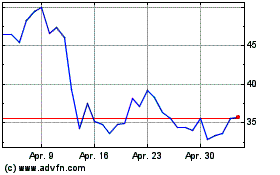

Avalanche (COIN:AVAXUSD)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

Avalanche (COIN:AVAXUSD)

Historical Stock Chart

Von Apr 2023 bis Apr 2024