Binance And Coinbase Temporarily Suspend USDC Conversion After Silicon Valley Bank Collapse

11 März 2023 - 2:20PM

NEWSBTC

The two biggest cryptocurrency exchanges, Binance and Coinbase,

have revealed that they would temporarily suspend USDC conversions

on their platforms. This comes in the aftermath of the collapse of

US lender Silicon Valley Bank and concerns about its effect on

USDC. Binance And Coinbase Suspend USDC Conversion

Binance was the first to make a move by announcing that

it had temporarily suspended its auto-conversion of USDC to BUSD.

Citing current market conditions, the exchange added that it was a

standard risk-management procedure while monitoring the market

situation. It should be noted that Binance had earlier in the

year courted controversy with its decision to auto-convert USDC

transactions to BUSD. At the time, Binance cited improving

liquidity for users, and it is unknown if this latest development

could lead to permanently delisting the stablecoin. Related

Reading: PancakeSwap TVL Drops 12%, Did This Exchange Received

A Lethal Blow? Following Binance’s announcement, Coinbase

also tweeted that it would pause its USDC conversion to

USD until Monday. The exchange noted that during heightened

activities, conversions rely on USD transfers from banks completed

during banking hours. It further added that conversions would

resume on Monday when banks reopen. Silicon Valley Bank’s

collapse has caused a ripple effect in the fintech company, with

several companies revealing their exposure to the U.S-based bank.

Some affected crypto companies include Pantera, Avalanche, and

BlockFi. Circle, the company behind USDC, revealed on Friday

that it had $3.3 billion of the $40 billion reserves backing the

stablecoin in the now-defunct bank. It added in a statement on

Twitter that Silicon Valley Bank was one of six banks it uses to

manage 25% of USDC reserves. Circle noted that it would

continue to operate normally while awaiting clarity from the FDIC

on how SVB collapse would affect depositors. USDC Market Cap

Decreases Following Circle Announcement Unsurprisingly

the crypto market has reacted to the news with investors removing

their assets from USDC. At the time of writing, more than $1.3

billion has been redeemed from the stablecoin in the past few

hours. The trading price of USDC has also suffered volatility

dropping from its pegged value of $1 to as low as $0.93, according

to data from CoinMarketCap. This is the lowest the stablecoin has

reached since its all-time low of $0.89 in May 2019. Its

marketcap has also reduced to $36 billion. Silicon Valley

Bank’s collapse has been tagged as the worst bank failure since

2008, and there’s uncertainty about what is next for the bank. Its

stock is down 87% in two days due to the crash and has been placed

into FDIC receivership. Related Reading: Bitcoin Timing

Tool Says This Might Be The Dip Worth Buying Experts have

hypothesized that other banks may likely suffer the same fate if

their business models and balance sheets are not properly managed

for rising interest rates and the growing possibility of a

recession. The consistent raising of interest rates by the Federal

Reserve could have been a significant factor to SVB’s

implosion. Featured Image from Unsplash, Charts from

Coingecko

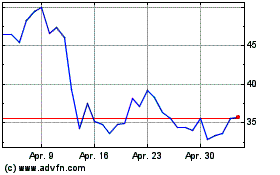

Avalanche (COIN:AVAXUSD)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

Avalanche (COIN:AVAXUSD)

Historical Stock Chart

Von Apr 2023 bis Apr 2024