Binance To Destroy $2 Billion Idle BUSD On The BNB Smart Chain (BSC)

22 Februar 2023 - 11:00PM

NEWSBTC

Binance, the world’s largest cryptocurrency exchange by trading

volume, will “destroy” $2 billion BUSD which idle on the BNB Smart

Chain (BSC), per a tweet on Feb. 22. Burning $2 Billion Of Idle

BUSD On The BSC BUSD is a stablecoin issued by Paxos on Ethereum

under the Binance brand. The stablecoin is pegged to the USD and is

backed by cash and cash reserves held in FDIC-insured banks in the

United States and treasury bills. Related Reading: Matrixport

Executive Thinks BUSD Crackdown Won’t Spread To All Stablecoins

Paxos is also regulated by the New York Department of Financial

Services (NYDFS) and is now the third-largest stablecoin by

circulating supply. As of Feb. 22, BUSD had a circulating

collection of $12.4 billion and continues to play a critical role

in Bitcoin and crypto trading, especially in centralized exchanges.

In crypto, stablecoins are channels through which users can convert

fiat currencies into fungible tokens, enabling smooth trading of

digital assets. Besides BUSD, there is USDT, which is the most

liquid, and USDC. Following this announcement, Binance plans

to destroy $2 billion of Wrapped BUSD on the BSC. Paxos only issues

BUSD on Ethereum, the first smart contracting platform. However,

considering the vast Binance ecosystem, the token can be bridged to

the BSC and other chains, including Tron and Avalanche, where it

exists as wrapped BUSD. It is this derived version of BUSD on

the BSC that Binance will burn. Later today, #Binance will

burn $2bn worth of idle BUSD on BNB Chain. The same amount of BUSD

on the Ethereum network, which was used as collateral, will then be

released. — Binance (@binance) February 22, 2023 In a tweet, the

exchange said all burnt-wrapped BUSD would be redeemed on Ethereum

and released to holders. The State Of BUSD And Previous

Collateral Criticism According to data, most BUSD trading volumes

are derived from centralized exchanges. Cryptocurrency exchanges,

including Binance and KuCoin, listing BUSD have generated over $8.7

billion in trading volumes in the last 24 hours. Trackers show that

CEX trading volumes stood at $8.6 billion, several folds higher

than DEX volumes at around $106 million. Related Reading: Binance’s

BUSD Reserves Steady At $13 Billion, Represents 18% Of All Assets

Early this year, it was reported by Wrapped BUSD wasn’t

always backed by reserves, sometimes between 2020 and 2021,

forcing holders to scramble, exiting the token on the BSC. However,

a Binance representative said the error had been noted and the

problem fixed. They pinned the issue to a “timing mismatch.”

Binance undertook a project to centralize the collateral in a

single, dedicated wallet; this was completed on Jan. 4 so that

users can see the 1:1 backing of PBUSD. Minting of PBUSD now only

takes place after the collateral is added to the dedicated

wallet. Trackers on Feb. 22 show that wrapped BUSD

is pegged with the USD. Feature image from Paxos, Chart from

TradingView.

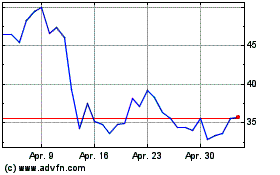

Avalanche (COIN:AVAXUSD)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

Avalanche (COIN:AVAXUSD)

Historical Stock Chart

Von Apr 2023 bis Apr 2024