Altcoins At Underbought Levels Not Seen Since Early January: Santiment

09 März 2023 - 5:30PM

NEWSBTC

On-chain data from Santiment shows altcoins are currently the most

underbought that they have been since early January. Altcoins Are

Currently Underbought According To MVRV As per data from the

on-chain analytics firm Santiment, altcoins are currently in the

opportunity zone. The relevant indicator here is the “Market Value

to Realized Value” (MVRV) ratio, which measures the ratio between

the market cap of any cryptocurrency and its realized cap. The

“realized cap” here is a capitalization model for an asset that

aims to provide a “true” value for it. The model works by putting

the value of each coin in circulation as the price at which it was

last transferred on the chain. This is different from the usual

market cap, which says all coins are worth the same as the current

price of the asset. Since the MVRV compares both of these caps, it

can provide hints about whether the given cryptocurrency is

underpriced or overpriced right now. When this indicator has a

value less than 1, it means the market cap is less than the

realized cap currently, and thus the asset in question may be

underbought right now. On the other hand, values of the metric

above this threshold imply the price of the coin (the market cap)

may be overinflated when compared to its actual value (the realized

cap). This could be a sign that the asset may be due for a

correction. Now, to more easily assess the MVRV ratio, what

Santiment has done is define an opportunity and a danger zone for

the altcoins. As is apparent from their names, these zones can

provide buy and sell signals for the assets. Related Reading:

Altcoins to Buy in 2023: Orbeon Protocol (ORBN), ApeCoin (APE) and

Collateral Network (COLT) The below chart shows the divergence of

the MVRV from these zones (meaning how far the metric is from them)

for different timeframes, for various altcoins in the sector: Looks

like most of the assets are currently inside the green zone |

Source: Santiment on Twitter As you can see in the above graph, the

opportunity zone occurs above 1, while the danger zone is below -1.

This is flipped from how the MVRV usually works, and this reversal

was intentional when Santiment defined the divergence. From the

chart, it’s visible that most of the altcoins currently have their

MVRV divergence inside the opportunity zone for various timeframes

(like 1-day, 7-day, 30-day, and more). Related Reading: Bitcoin

“Social Dominance” Surges As Altcoins Struggle Historically, when

the MVRV of any asset has shown this pattern, the price has become

more likely to rise as during this condition, the coin can be

thought to be underbought. The reason behind the altcoins becoming

underpriced right now is that their prices have taken quite the

beating since this month of March kicked off. “Prices can of course

still fall further,” notes Santiment. “But this is the most crypto

assets have been in opportunity zones since early January.” BTC

Price At the time of writing, Bitcoin is trading around $21,700,

down 7% in the last week. BTC has declined over the past day |

Source: BTCUSD on TradingView Featured image from Art Rachen on

Unsplash.com, charts from TradingView.com, Santiment.net

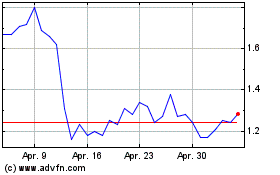

ApeCoin (COIN:APEUSD)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

ApeCoin (COIN:APEUSD)

Historical Stock Chart

Von Apr 2023 bis Apr 2024