Ethereum Shows Signs Of Exhaustion, But Could It Still Touch $1,700?

22 Juli 2022 - 5:55PM

NEWSBTC

The crypto market has extended its bullish momentum despite recent

tailwinds, Ethereum continues to lead in this recovery. The second

crypto by market cap trades at $1,600 with a 35% profit in the past

week. Related Reading | Crypto Market On The Mend: ApeCoin And

Curve DAO Show Gains Trading firm QCP Capital shared a market

update claiming the current bullish price action has been a

“pleasant surprise for all”. This price action started on the back

of the latest U.S. Consumer Price Index (CPI) print; a metric used

to measure inflation. The CPI stands at a 40-year high which was

expected to have a negative impact on the crypto market. The

opposite occurred, the trading firm claims, due to market

participants expecting lower inflation in the coming months. This

potential decline in inflation could give some room for risk asset

to continue their rally and persuade the U.S. Federal Reserve (Fed)

from ruling out a 100-basis point (bps) interest rate hike. The

financial institution will announce its decision on July 27. QCP

Capital said: Currently, a 20% chance of 100bps is still being

priced in but our view is that 75bps is the most the Fed will do.

So expect another boost as 100 bps gets completely priced out.

Ethereum is leading the relief because there is more clarity around

the upcoming “Merge”, an event set to combine this network’s

execution layer with its consensus layer. Thus, consolidating

Ethereum’s migration to a Proof-of-Stake (PoS) consensus protocol.

“The Merge” has been tentatively scheduled for September which has

contributed to the shift in the general sentiment across the crypto

market and supported this rally. The bullish price action, QCP

Capital said, has been “keenly felt in the options market”. The

sector saw a “rush” to purchase buy contracts (calls) for the

September expiry. In other words, options traders are bullish on

the potential impact that “The Merge” will have on Ethereum. Can

Ethereum Extend Current Rally? Conversely, the options markets hint

at potential exhaustion for Ethereum in the short term. QCP Capital

records an increase in calls selling for ETH’s price and believes

insolvencies announcements from other companies could operate as

tailwinds for the second crypto by market cap. Part of the

contagion triggered by the default of crypto hedge fund Three

Arrows Capital (3AC), which failed to honor billions in debts from

their counterparties, many companies have been negatively impacted.

This includes Celsius, BlockFi, Voyager, and Genesis. These

companies have had to halt their operations at some levels with new

companies announcing that they have been affected by 3AC coming out

almost every week. Yesterday, crypto exchange Zipmex suspended

withdrawals, and there have been growing rumors about other

companies taking similar measures. Related Reading | Solana

(SOL) To Hit $166 By 2025, Despite Current Bearish Conditions QCP

Capital said: While the markets have been sanguine, it might not be

completely free of the credit contagion yet. We have been adding to

our downside skew position and we are keeping slightly long gamma

and vega (longer term options).

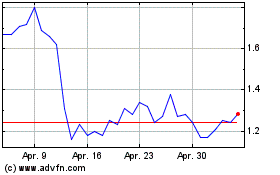

ApeCoin (COIN:APEUSD)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

ApeCoin (COIN:APEUSD)

Historical Stock Chart

Von Apr 2023 bis Apr 2024