Glassnode On Bitcoin Mining: Difficulty Reaches ATH, Profitability Decreases

11 Oktober 2022 - 12:28PM

NEWSBTC

The latest Glassnode report focuses on the topic of the day:

bitcoin mining. While bitcoin’s price has been suspiciously flat

for a while, the difficulty adjustment came in and registered an

all-time high. Do the miners know something we don’t? Or is there a

transfer of power going on behind the scenes? Glassnode poses a

working theory on their latest The Week On-Chain. To begin with,

Glassnode puts the difficulty adjustment into perspective: “Bitcoin

hashrate has reached a new all-time-high of 242 Exahash per second.

To give an analogy for scale, this is equivalent to all 7.753

Billion people on earth, each completing a SHA-256 hash calculation

approximately 30 Billion times every second.” The thing is, we’re

in a bear market. The sentiment is fearful. There’s trouble brewing

everywhere in the world and bitcoin has been boring for a while

now. What could be the reason for a hashrate all-time high? Is it,

as Glassnode theorizes, “a new dynamic as more of the hashpower is

held by better capitalised publicly traded mining companies”? Or is

it just the game theory behind bitcoin at work? Remember that

mining revenue is also down and the cost to produce one bitcoin is

going up in tandem with electricity prices. Related Reading:

Glassnode: Bitcoin Is Currently In “Bear To Bull” Transition Period

Making the situation more volatile, the miner revenue’s bitcoin is

at a low point. This “should, in theory, create elevated income

stress on the mining industry.” Add bitcoin’s stable prices to that

equation and, what do we have? “It is extremely rare for BTC prices

to stay so stationary for long, suggesting heightened probabilities

of volatility on the horizon.” Bitcoin Hashrate All-Time High |

Source: The Week On-Chain Bullish Signal: Bitcoin Hash-Ribbons

Unwind According to Glassnode, “the Bitcoin hash-ribbons commenced

an unwind in late August, providing an indication that mining

conditions were improving, and hashrate was coming back online.”

What does this mean and why is it bullish, though? “Almost all

historical hash-ribbon unwinds have preceded greener pastures in

the months that followed.” According to Glassnode, since bitcoin’s

price is still flatlining, the “hashrate rise is due to more

efficient mining hardware coming online and/or miners with superior

balance sheets having a larger share of the hashpower network.”

That’s the base of Glassnode’s takeover theory. Glassnode Proposes

“The Mining Halving” Concept Another of their wild theories,

Glassnode poses that “a 66% increase in Difficulty and Hashrate

since Oct-2020 corresponds to an approximate halving in revenue per

hash.” And to support that, they provide these numbers: “the

revenue earned per Exahash has been in a persistent and long-term

downtrend, with the BTC-denominated reward currently at an

all-time-low of 4.06 BTC per EH per day.” So, if miners are getting

destroyed by market conditions, why is the hashrate recording

all-time highs? The answer might lie with the Puell Multiple,

“which is a cyclical oscillator that compares the current daily

mining revenue to their yearly average.” According to this

indicator, the mining business is actually gaining ground against

previous performance. “The Puell Multiple hit the current

lows of around 0.33 in June, indicating that miners were earning

just 33% of their yearly average revenue. It has since recovered to

around 0.63, implying a degree of stress relief, and adjustment to

this new pricing regime.” According to Glassnode, this relief might

mean that “a true bear market low is established.” BTC price chart

for 10/11/2022 on Bitstamp | Source: BTC/USD on TradingView.com

Glassnode Thinks There’s Still Capitulation Risk Let’s be clear,

bitcoin is walking a tightrope at the moment. The market is about

to break and the pendulum could swing either way. Even though there

are reasons to be optimistic, the smart investor should prepare for

the worst. “By numerous models, we estimate that the average cost

of BTC production hovers just below current prices, such that any

significant price decline could turn an implied income stress, into

acute and explicit stress.” Related Reading: Glassnode Report Shows

Bitcoin And Ethereum Derivatives Gain Massive Traction To assess

the risk, Glassnode determined “the aggregate size of miner

balances” to 78.4K BTC. The owners of those reserves “may come

under income stress,” but “It is extremely unlikely this full

amount would be distributed.” And that’s where we stand at the

moment. Featured Image by Icons8_team from Pixabay | Charts by

TradingView and The Week On-Chain

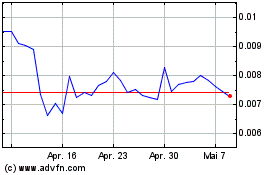

Amp (COIN:AMPUSD)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

Amp (COIN:AMPUSD)

Historical Stock Chart

Von Apr 2023 bis Apr 2024

Echtzeit-Nachrichten über Amp (Cryptocurrency): 0 Nachrichtenartikel

Weitere Amp News-Artikel