Cardano DeFi TVL Rises More Than 100% In One Month

07 Februar 2023 - 11:30AM

NEWSBTC

DeFi protocols in Cardano, a proof-of-stake smart contracting

platform, have locked over $100 million in user assets as of

February 7. According to DeFiLlama statistics, Cardano

DeFi protocols command a total value locked (TVL) of slightly over

$103 million, which is more than 2X the amount on January 1. Early

this year, Cardano TVL stood at $48.95 million. The upswing of TVL

could be because of several factors. However, top of the list is

the broader recovery in the crypto markets. The rising tide of

Bitcoin, which rose from below $15,000 to over $24,000 in early

February, supported ADA’s rise, Cardano’s native currency.

Cardano’s DeFi TVL is expanding faster than the overall market. To

illustrate, from January 1 to February 7, the total DeFi TVL across

all chains rose from around $38 billion to $48 billion, an

increment of approximately 20%. During this time, Cardano DeFi TVL

rose by over 100%. Related Reading: Cardano (ADA) Up By Over 65% In

2023 – Here’s Why ADA Prices Are Recovering, Developers Are

Building The fact is there could be several factors behind the

revival of DeFi activities in Cardano. After a biting crypto winter

which saw ADA drop by more than 70% from 2021 highs, markets appear

to be recovering. This may be boosting users’ confidence to engage

in DeFi, including in protocols launched on Cardano. The

proof-of-stake smart contracting platform has also been

implementing changes and adding features to enhance

scalability. Under Basho, the goal of Cardano developers is

to boost performance and scalability. Cardano is based on Bitcoin’s

code but with smart contracting capability, which was activated via

Alonzo, marking the end of Goguen. Cardano uses an unspent

transaction output (UTXO) model, diverging from account-based

systems like Ethereum, where the validator can prioritize

transactions by tagging higher fees. Therefore, users in Cardano

know beforehand the fees they pay. All transactions are queued via

an off-chain sequencer and confirmed on-chain. The Launch of Djed,

An Overcollateralized Stablecoin MinSwap, a decentralized

exchange, dominates with a 32% market share, managing $34.07

million in user assets. Djed, an overcollateralized stablecoin

developed by Input-Output Global (IOG) and COTI, has a TVL of

$11 million. Related Reading: Cardano Whales, Sharks Have

Accumulated 406M ADA In 2023: Santiment The stablecoin was launched

in early February 2023 after a year in development, and the

developer said it is overcollateralized by between 400% and 800% by

ADA. IOG said the stablecoin would offer an alternative to volatile

crypto assets currently being used in the smart contracting

platform. MinSwap, MuesliSwap, and WingRiders are some of the DeFi

protocols that have supported Djed. However, Djed could be

integrated into over 40 projects in the Ethereum competitor in the

coming months. As of the time of writing on February 7, ADA is

changing hands at $0.38, down 3% in the past trading week but up

roughly 68% from December lows. Feature image from Flickr, Chart

from TradingView

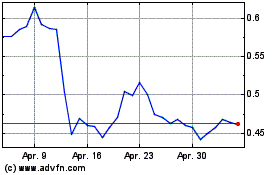

Cardano (COIN:ADAUSD)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

Cardano (COIN:ADAUSD)

Historical Stock Chart

Von Apr 2023 bis Apr 2024