UniCredit Shares Climb After Guidance Raise

27 Juli 2022 - 10:52AM

Dow Jones News

By Ed Frankl

Shares in UniCredit SpA rose Wednesday after it raised full-year

guidance after reporting its strongest first-half performance in

nearly a decade.

Shares at 0810 GMT were up 6.6% to EUR9.21.

The Italian bank now expects to report revenue excluding Russia

for the year of at least 16.7 billion euros ($16.9 billion)

compared with previous guidance of EUR16 billion.

The company also said it asked for a regulatory green light from

the European Central Bank for a new EUR1 billion buyback.

UniCredit posted a net profit of EUR1.82 billion for the quarter

compared with EUR960 million a year earlier, well above consensus

of EUR996 million, according to analysts' expectations provided by

the company.

The company reported a stronger-than-expected operating

performance and balance-sheet derisking, including via lower

nonperforming loans and Russia exposure, Citi analysts Azzurra

Guelfi and Guru Prasad Chowdhary say in a research note.

The bank should expect a higher consensus earnings per share,

and investors will also focus on its ability to deliver on its

capital returns, they added.

Revenue rose to EUR4.78 billion from EUR4.39 billion in the same

period of 2021, and compared with a consensus of EUR4.51

billion.

Common equity Tier 1 ratio--a measure of banks' capital

strength--stood at 15.7% at the end of the quarter, up from 14% at

the end of the prior quarter and 15.5% a year earlier. UniCredit

has a 2022-24 target of 12.5%-13.0%.

Ian Walker and Cristina Roca contributed to this article.

Write to Ed Frankl at edward.frankl@dowjones.com

(END) Dow Jones Newswires

July 27, 2022 04:37 ET (08:37 GMT)

Copyright (c) 2022 Dow Jones & Company, Inc.

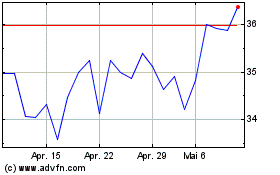

Unicredit (BIT:UCG)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

Unicredit (BIT:UCG)

Historical Stock Chart

Von Apr 2023 bis Apr 2024