New record year for LVMH in 2022

. Revenue 79 billion euros

. Profit from recurring operations 21

billion euros. Both up

23% . A strong social and

economic footprint in France

Paris, January 26th, 2023

LVMH Moët Hennessy Louis Vuitton, the world’s

leading luxury goods group, recorded revenue of €79.2 billion in

2022 and profit from recurring operations of €21.1 billion, both up

23%.

All business groups achieved significant organic

revenue growth over the year (see table on page 3). Fashion &

Leather Goods notably reached record levels, with organic revenue

growth of 20%. Profit from recurring operations stood at €21.1

billion for 2022, up 23%. Operating margin remained at the same

level as 2021. Group share of net profit was €14.1 billion, up 17%

compared to 2021. Operating free cash flow surpassed €10

billion.

Europe, the United States and Japan rose

sharply, benefiting from strong demand from local customers and the

recovery of international travel. Asia was stable over the year due

to developments in the health situation in China.

Bernard Arnault, Chairman and CEO of LVMH, said:

“Our performance in 2022 illustrates the exceptional appeal of our

Maisons and their ability to create desire during a year affected

by economic and geopolitical challenges. The Group once again

recorded significant growth in revenue and earnings. Our growth

strategy, based on the complementary nature of our activities, as

well as their geographic diversity, encourages innovation and the

quality of our creations, the excellence of their distribution, and

adds a cultural and historical dimension thanks to the heritage of

our Maisons. This was showcased during our hugely successful LVMH

Journées Particulières, when we opened our doors to all in fifteen

countries in 2022 and saw a record number of visitors come to learn

about the know-how of our artisans. We approach 2023 with

confidence but remain vigilant due to current uncertainties. We

count on the desirability of our Maisons and the agility of our

teams to further strengthen our lead in the global luxury market

and support France’s prestige throughout the world.”

Highlights of 2022 include:

- A record year despite the geopolitical and economic

situation,

- Significant revenue growth for all business groups and market

share gains worldwide,

- Strong growth in business in Europe, Japan and the United

States,

- Good growth in Champagne and Cognac, based on a value creation

strategy,

- A remarkable performance by the Fashion & Leather Goods

business group, notably Louis Vuitton, Christian Dior, Celine,

Fendi, Loro Piana, Loewe and Marc Jacobs, which are gaining market

share globally and reaching record levels of revenue and

earnings,

- Louis Vuitton revenue surpassed 20 billion euros, for the first

time,

- Strong growth in perfumes. The continued global success of

Dior’s Sauvage, once again world leader in 2022,

- Sustained creative momentum for all our Watches & Jewelry

Maisons, in particular Tiffany, Bulgari and TAG Heuer,

- A remarkable rebound for Sephora, which confirmed its place as

world leader in the distribution of beauty products,

- Operating investments of nearly €5 billion, mainly dedicated to

the expansion of the store network, the development of production

facilities and employment,

- Operating free cash flow of more than €10 billion.

LVMH, a strong social economic footprint

in France and around the world:

- 39,000 young people recruited worldwide in

2022.

- In France, LVMH recruited more than 15,000 people in

2022, which makes the Group the leading private recruiter

in the country.

- In 2022, LVMH invested nearly 215 million

euros in training its employees.

- In France, one job created directly by LVMH generates

four for the French economy. That is equivalent to around

160,000 people working indirectly for the Group.

- More than 500 stores and 110 manufacturing

facilities and workshops located

across France.

- LVMH opens several manufacturing facilities each year

in France, notably for Louis Vuitton.

- Five billion in corporation taxes paid

worldwide, almost half of which in France.

- More than one billion euros invested in France

each year.

- On average over recent years, the total fiscal

footprint (corporation tax + VAT + social charges) of

LVMH in France is more than 4.5 billion euros per

year.

- The salaries of the group's employees are among the most

competitive in their sector of activity.

- Most of our employees in France benefit from

profit-sharing, with an overall total for the group of 400 million

euros in 2022.

- LVMH has been recognized for its leadership in terms of

transparency and performance in matters concerning the

protection of the climate, forests and water by the CDP (Carbon

Disclosure Project), a global not-for-profit environmental

organization and is now one of 12 companies in the world to

have obtained a triple “A” rating out of more than 15,000

rated companies.

Key figures

|

Euro Millions |

2021 |

2022 |

Change 2022/2021 |

|

Revenue |

64 215 |

79 184 |

+ 23 % |

|

Profit from recurring operations |

17 151 |

21 055 |

+ 23 % |

|

Group share of net profit |

12 036 |

14 084 |

+ 17 % |

|

Operating free cash flow |

13 531 |

10 113 |

- 25% |

|

Net financial debt |

9 607 |

9 201 |

- 4 % |

|

Total equity |

48 909 |

56 604 |

+ 16 % |

Revenue by business group:

|

Euro Millions |

2021 |

2022 |

Change 2022/2021

Reported

Organic* |

|

Wines & Spirits |

5 974 |

7 099 |

+ 19 % |

+ 11 % |

|

Fashion & Leather Goods |

30 896 |

38 648 |

+ 25 % |

+ 20 % |

|

Perfumes & Cosmetics |

6 608 |

7 722 |

+ 17 % |

+ 10 % |

|

Watches & Jewelry |

8 964 |

10 581 |

+ 18 % |

+ 12 % |

|

Selective Retailing |

11 754 |

14 852 |

+ 26 % |

+ 17 % |

|

Other activities and eliminations |

19 |

282 |

- |

- |

|

Total LVMH |

64 215 |

79 184 |

+ 23 % |

+ 17 % |

* with comparable structure and constant exchange

rates. The structural impact for the Group was zero and the

currency effect was +6 %.

Profit from recurring operations

by business group:

|

Euro Millions |

2021 |

2022 |

Change 2022/2021 |

|

Wines & Spirits |

1 863 |

2 155 |

+ 16 % |

|

Fashion & Leather Goods |

12 842 |

15 709 |

+ 22 % |

|

Perfumes & Cosmetics |

684 |

660 |

- 3 % |

|

Watches & Jewelry |

1 679 |

2 017 |

+ 20% |

|

Selective Retailing |

534 |

788 |

+ 48 % |

|

Other activities and eliminations |

(451) |

(274) |

- |

|

Total LVMH |

17 151 |

21 055 |

+ 23 % |

Wines & Spirits: record level of

revenue and earnings

The Wines & Spirits

business group recorded revenue growth of 19% in 2022 (11% on an

organic basis). Profit from recurring operations was up 16%.

Champagne volumes were up 6%, driven by sustained demand leading to

growing pressure on supplies. Momentum was particularly strong in

Europe, Japan and in emerging markets, particularly in “high

energy” channels and gastronomy. Hennessy cognac benefited from its

value creation strategy. The dynamic policy of price increases

offset the effects of the health situation in China, while the

United States was affected at the start of the year by logistical

disruptions. Still wines, in particular the Château d’Esclans rosé,

achieved an excellent performance. Moët Hennessy strengthened its

global portfolio of exceptional wines with the acquisition of the

Joseph Phelps vineyard, one of the most renowned wine properties in

Napa Valley, California.

Fashion &

Leather Goods: exceptional

performances by Louis Vuitton, Christian Dior, Celine,

Fendi, Loro Piana, Loewe and Marc Jacobs

The Fashion & Leather Goods

business group recorded revenue growth of 25% in 2022 (20% on an

organic basis). Profit from recurring operations was up 22%. Louis

Vuitton had an excellent year, again driven by its exceptional

creativity, the quality of its products and its strong ties with

art and culture. The women's ready-to-wear fashion shows created by

Nicolas Ghesquière were extremely well-received. Many new products

were unveiled in leather goods, jewelry and watches. Meanwhile, the

new "LV Dream" exhibition in Paris pays tribute to 160 years of

creative exchanges that fuel Louis Vuitton's spirit of innovation,

and a new collaboration with Japanese artist Yayoi Kusama was

unveiled, revisiting iconic creations of the Maison. Christian Dior

continued its remarkable growth trajectory across all its product

lines. After three years of renovations, the Maison’s historic

store at 30 avenue Montaigne, which reopened in Paris in early

2022, enjoyed huge success, offering a new experience of the

highest refinement. Its fashion shows continued to offer

exceptional moments, whether in Seville, Spain, for the women's

collections of Maria Grazia Chiuri, or in Egypt at the foot of the

Giza pyramids for the men's show imagined by Kim Jones. Celine

experienced very strong growth thanks to the success of Hedi

Slimane's creations and his extremely modern and precise vision, as

did Loewe, driven by the strong creativity of J.W. Anderson. Fendi

celebrated the 25th anniversary of its iconic Baguette bag in New

York. Loro Piana, Rimowa and Marc Jacobs also had an excellent

year.

Perfumes &

Cosmetics: strong momentum in perfume

and continued selective

distribution

The Perfumes & Cosmetics

business group recorded revenue growth of 17% in 2022 (10% on an

organic basis). Profit from recurring operations was slightly down

as a result of a very selective policy of distribution to assert

itself in the prestige universe. Christian Dior enjoyed a

remarkable performance, strengthening its lead. Sauvage confirmed

its position as the world's leading perfume, while the iconic

women's fragrances Miss Dior and J'adore, enriched with its latest

creation Parfum d'Eau, continued to grow. Dior Addict in make-up

and Prestige in skincare also contributed to the rapid growth of

the Maison. Guerlain sustained its growth, driven notably by the

vitality of its Abeille Royale skincare, its Aqua Allegoria

collection and its exceptional perfumes L’Art et la Matière.

Parfums Givenchy benefited from the continued success of its

fragrances. Fenty Beauty doubled its revenue thanks to the

expansion of its distribution network and the success of its

launches.

Watches & Jewelry: rapid growth in

jewelry and watches

The Watches & Jewelry

business group recorded revenue growth of 18% in 2022 (12% on an

organic basis). Profit from recurring operations was up 20%.

Tiffany & Co. had a record year, driven by its increasing

desirability. While its High Jewelry revenue doubled, the new Lock

bracelet collection, rolled out in North America, enjoyed great

success alongside other iconic lines. The “Vision & Virtuosity”

exhibition at the Saatchi Gallery in London showcased 185 years of

creativity and know-how of the Maison over the summer. Bvlgari

confirmed its strong momentum, particularly in Europe, Japan and

the United States. The iconic Serpenti line and the High Jewelry

and High Watchmaking collections were the main growth drivers. The

Octo Finissimo Ultra watch broke a new record of thinness. Chaumet

had a good year and celebrated nature with its “Végétal” exhibition

in Paris. Fred showed strong growth and launched its first

retrospective exhibition at the Palais de Tokyo in Paris. In the

watchmaking sector, TAG Heuer unveiled, among other innovations,

the Carrera Plasma, an avant-garde fusion of watchmaking and lab

grown diamonds. As official timekeeper, Hublot enjoyed strong

visibility during the 2022 Football World Cup. Zenith continued to

expand its in-store and online distribution.

Selective Retailing: excellent

performance by Sephora; DFS impacted by the health situation in

China

Selective Retailing revenue was

up 26% in 2022 (17% on an organic basis). Profit from recurring

operations was up 48%. With a strong rebound in activity in its

stores, Sephora enjoyed a record performance in both revenue and

earnings. Momentum was particularly strong in North America,

Europe, the Middle East and in most Southeast Asian countries.

Further investments were made into Sephora's omnichannel strategy

in order to continuously improve its customers’ purchasing

experience both online and in-store. The network continued to

expand notably due to the partnership with Kohl's in the United

States. Sephora’s Russian business was divested. DFS was still

affected by the health situation in China. The flagship

destinations of Hong Kong and Macau particularly suffered as a

result of the suspension of domestic travel and the complete

absence of tourists but just reopened in January. Le Bon Marché,

which is growing strongly, continued to develop innovative concepts

and benefit from the return of loyal French customers and

international travellers.

Confidence in 2023

With the month of January having started well

and despite an uncertain geopolitical and economic environment,

LVMH is confident in its ability to continue the growth observed in

2022. The Group will pursue its brand development focused strategy,

underpinned by continued innovation and investment as well as a

constant quest for desirability and quality in its products and

their distribution.

Driven by the agility of its teams, their

entrepreneurial spirit and its well diversified presence across

businesses and geographic areas in which its customers are located,

LVMH enters 2023 with confidence and once again, sets an objective

of reinforcing its global leadership position in luxury goods.

Dividend 2022

At the General Meeting of April 20, 2023, LVMH

will propose a dividend of 12 euros per share. An interim dividend

of 5 euros per share was paid on December 5 of last year. The

balance of 7 euros will be paid on April 27, 2023.

The Board of Directors met on January 26th to

approve the financial statements for 2022. Audit procedures have

been carried out and the audit report is being issued.

The regulated information related to this press

release as well as the presentation of the annual results and the

“Financial documents” report are available on the website

www.lvmh.com.

Details of the webcast relating to the publication

of the 2022 annual results are available at:

https://www.lvmh.com/.

APPENDIX

Condensed consolidated accounts for 2022 are

included in the PDF version of the press release.

LVMH - Revenue by business group and by

quarter

2022 Revenue (Euro

millions)

|

Year 2022 |

Wines & Spirits |

Fashion & Leather Goods |

Perfumes & Cosmetics |

Watches & Jewelry |

Selective retailing |

Other activities and eliminations |

Total |

|

First quarter |

1 638 |

9 123 |

1 905 |

2 338 |

3 040 |

(41) |

18 003 |

|

Second quarter |

1 689 |

9 013 |

1 714 |

2 570 |

3 591 |

149 |

18 726 |

|

First half |

3 327 |

18 136 |

3 618 |

4 909 |

6 630 |

109 |

36 729 |

|

Third quarter |

1 899 |

9 687 |

1 959 |

2 666 |

3 465 |

79 |

19 755 |

|

First nine months |

5 226 |

27 823 |

5 577 |

7 575 |

10 095 |

189 |

56 485 |

|

Fourth quarter |

1 873 |

10 825 |

2 145 |

3 006 |

4 757 |

93 |

22 699 |

|

Total 2022 |

7 099 |

38 648 |

7 722 |

10 581 |

14 852 |

282 |

79 184 |

2022 Revenue (Organic change verses same

period of 2021)

|

Year 2022 |

Wines & Spirits |

Fashion & Leather Goods |

Perfumes & Cosmetics |

Watches & Jewelry |

Selective retailing |

Other activities and eliminations |

Total |

|

First quarter |

+ 2 % |

+ 30 % |

+ 17 % |

+ 19 % |

+ 24 % |

- |

+ 23 % |

|

Second quarter |

+ 30% |

+ 19 % |

+ 8 % |

+ 13 % |

+ 20 % |

- |

+ 19 % |

|

First half |

+ 14 % |

+ 24 % |

+ 13 % |

+ 16 % |

+ 22 % |

- |

+ 21 % |

|

Third quarter |

+ 14 % |

+ 22 % |

+ 10 % |

+ 16 % |

+ 15 % |

- |

+ 19 % |

|

First nine months |

+ 14 % |

+ 24 % |

+ 12 % |

+ 16 % |

+ 20 % |

- |

+ 20 % |

|

Fourth quarter |

+ 4 % |

+ 10 % |

+ 5 % |

+ 3 % |

+ 12 % |

- |

+ 9 % |

|

Total 2022 |

+ 11 % |

+ 20 % |

+ 10 % |

+ 12 % |

+ 17 % |

- |

+ 17 % |

2021 Revenue (Euro

millions)

|

Year 2021 |

Wines & Spirits |

Fashion & Leather Goods |

Perfumes & Cosmetics |

Watches & Jewelry |

Selective retailing |

Other activities and eliminations |

Total |

|

First quarter |

1 510 |

6 738 |

1 550 |

1 883 |

2 337 |

(59) |

13 959 |

|

Second quarter |

1 195 |

7 125 |

1 475 |

2 140 |

2 748 |

23 |

14 706 |

|

First half |

2 705 |

13 863 |

3 025 |

4 023 |

5 085 |

(36) |

28 665 |

|

Third quarter |

1 546 |

7 452 |

1 642 |

2 137 |

2 710 |

25 |

15 512 |

|

First nine months |

4 251 |

21 315 |

4 668 |

6 160 |

7 795 |

(12) |

44 177 |

|

Fourth quarter |

1 723 |

9 581 |

1 941 |

2 804 |

3 959 |

30 |

20 038 |

|

Total 2021 |

5 974 |

30 896 |

6 608 |

8 964 |

11 754 |

19 |

64 215 |

Alternative performance

measures

For the purposes of its financial communication,

in addition to the accounting aggregates defined by the IAS/IFRS

standards, LVMH uses alternative performance measures established

in accordance with AMF’s position DOC-2015-12.

The table below lists these measures and the

reference to their definition and their reconciliation with the

aggregates defined by the IAS/IFRS in the published documents.

|

Measures |

Reference to published documents |

|

Operating free cash flow |

FD (condensed consolidated financial statements, consolidated cash

flow statement) |

|

Net financial debt |

FD (Notes 1.23 and 19 of the appendix to the consolidated financial

statements) |

|

Gearing |

FD (Part 7, Comments on the Consolidated Balance Sheet) |

|

Organic growth |

FD (Part 1, Comments on the Consolidated Income Statement) |

FD: Financial documents as at December 31,

2022

LVMH

LVMH Moët Hennessy Louis Vuitton is represented

in Wines and Spirits by a portfolio of brands that includes Moët

& Chandon, Dom Pérignon, Veuve Clicquot, Krug, Ruinart,

Mercier, Château d’Yquem, Domaine du Clos des Lambrays, Château

Cheval Blanc, Colgin Cellars, Hennessy, Glenmorangie, Ardbeg,

Belvedere, Woodinville, Volcán de Mi Tierra, Chandon, Cloudy Bay,

Terrazas de los Andes, Cheval des Andes, Cape Mentelle, Newton,

Bodega Numanthia, Ao Yun, Château d’Esclans, Château Galoupet and

Joseph Phelps. Its Fashion and Leather Goods division includes

Louis Vuitton, Christian Dior, Celine, Loewe, Kenzo, Givenchy,

Fendi, Emilio Pucci, Marc Jacobs, Berluti, Loro Piana, RIMOWA,

Patou. LVMH is present in the Perfumes and Cosmetics sector with

Parfums Christian Dior, Guerlain, Parfums Givenchy, Kenzo Parfums,

Perfumes Loewe, Benefit Cosmetics, Make Up For Ever, Acqua di

Parma, Fresh, Fenty Beauty by Rihanna, Maison Francis Kurkdjian and

Officine Universelle Buly. LVMH's Watches and Jewelry division

comprises Bulgari, Tiffany & Co., TAG Heuer, Chaumet, Zenith,

Fred and Hublot. LVMH is also active in selective retailing as well

as in other activities through DFS, Sephora, Le Bon Marché, La

Samaritaine, Groupe Les Echos, Cova, Le Jardin d’Acclimatation,

Royal Van Lent, Starboard Cruise Services, Belmond and Cheval Blanc

hotels.

“This document may contain certain forward

looking statements which are based on estimations and forecasts. By

their nature, these forward looking statements are subject to

important risks and uncertainties and factors beyond our control or

ability to predict, in particular those described in LVMH’s

Universal Registration Document which is available on the website

(www.lvmh.com). These forward looking statements should not be

considered as a guarantee of future performance, the actual results

could differ materially from those expressed or implied by them.

The forward looking statements only reflect LVMH’s views as of the

date of this document, and LVMH does not undertake to revise or

update these forward looking statements. The forward looking

statements should be used with caution and circumspection and in no

event can LVMH and its Management be held responsible for any

investment or other decision based upon such statements. The

information in this document does not constitute an offer to sell

or an invitation to buy shares in LVMH or an invitation or

inducement to engage in any other investment activities.”

LVMH CONTACTS

|

Analysts and investors Chris Hollis / Rodolphe

Ozun LVMH + 33 1 44 13 21 22 / + 33 1 44 13 27 21 |

Media Jean-Charles Tréhan LVMH + 33 1 44 13 26

20 |

|

MEDIA CONTACTS |

|

|

France Charlotte Mariné / +33 6 75 30 43 91 Axelle

Gadala / +33 6 89 01 07 60 Publicis Consultants +33 1 44 82 46

05 |

France Michel Calzaroni / + 33 6 07 34 20 14

Olivier Labesse / Hugues Schmitt / Thomas Roborel de Climens / + 33

6 79 11 49 71 |

|

Italy Michele Calcaterra / Matteo Steinbach SEC

and Partners + 39 02 6249991 |

UK Hugh Morrison / Charlotte McMullen Montfort

Communications + 44 7921 881 800 |

|

US Nik Deogun / Blake Sonnenshein Brunswick Group

+ 1 212 333 3810 |

China Daniel Jeffreys Deluxewords +

44 772 212 6562 + 86 21 80 36 04 48 |

- Press Release - LVMH 2022 FY Results

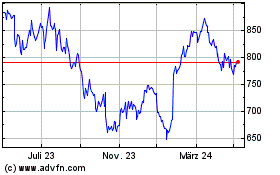

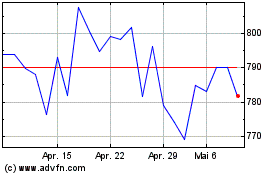

Lvmh Moet Hennessy Louis... (BIT:1MC)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

Lvmh Moet Hennessy Louis... (BIT:1MC)

Historical Stock Chart

Von Apr 2023 bis Apr 2024