Societe Generale: Disclosure of regulatory capital requirements as from 1st January 2023

15 Dezember 2022 - 8:41PM

Societe Generale: Disclosure of regulatory capital requirements as

from 1st January 2023

DISCLOSURE OF REGULATORY CAPITAL REQUIREMENTS AS FROM

1st JANUARY

2023

Press release

Paris, December 15th 2022

The European Central Bank notified the level of

requirement in respect of P2R (Pillar 2 Requirement) for Societe

Generale, which will apply from 1st January 2023. This level stands

at 2.14%, including the additional requirement regarding pillar 2

prudential expectations on calendar provisioning regarding

non-performing loans granted before 26 April 2019.

Considering the combined regulatory buffers, the

minimum requirements applicable to Societe Generale on a

consolidated basis will be respectively 9.36% for the CET1 ratio,

11.26% for the Tier 1 ratio and 13.80% for the Total Capital ratio

as of 1st January 2023.

With a CET1 ratio at 13.1% (1) as of 30

September 2022, the Group benefits from a comfortable pro-forma

buffer of around 370 basis points above the threshold for

triggering distribution limitations.

(1) Including IFRS 9

phasing. Based on CRR2/CRD5 rules, including the Danish compromise

for insurance. Press contacts:Jean-Baptiste Froville_+33 1

58 98 68 00_

jean-baptiste.froville@socgen.comFanny

Rouby_+33 1 57 29 11 12_

fanny.rouby@socgen.com

Societe Generale

Societe Generale is one of the leading European

financial services groups. Based on a diversified and integrated

banking model, the Group combines financial strength and proven

expertise in innovation with a strategy of sustainable growth.

Committed to the positive transformations of the world’s societies

and economies, Societe Generale and its teams seek to build, day

after day, together with its clients, a better and sustainable

future through responsible and innovative financial

solutions.Active in the real economy for over 150 years, with a

solid position in Europe and connected to the rest of the world,

Societe Generale has over 117,000 members of staff in 66 countries

and supports on a daily basis 25 million individual clients,

businesses and institutional investors around the world by offering

a wide range of advisory services and tailored financial solutions.

The Group is built on three complementary core businesses:

- French

Retail Banking which encompasses the Societe Generale,

Credit du Nord and Boursorama brands. Each offers a full range of

financial services with omnichannel products at the cutting edge of

digital innovation;

-

International Retail Banking, Insurance and Financial

Services, with networks in Africa, Central and Eastern

Europe and specialised businesses that are leaders in their

markets;

- Global Banking and Investor

Solutions, which offers recognised expertise, key

international locations and integrated solutions.

Societe Generale is included in the principal

socially responsible investment indices: DJSI (Europe), FTSE4Good

(Global and Europe), Bloomberg Gender-Equality Index, Refinitiv

Diversity and Inclusion Index, Euronext Vigeo (Europe and

Eurozone), STOXX Global ESG Leaders indexes, and the MSCI Low

Carbon Leaders Index (World and Europe). In case of doubt regarding

the authenticity of this press release, please go to the end of

Societe Generale’s newsroom page where official Press Releases sent

by Societe Generale can be certified using blockchain technology. A

link will allow you to check the document’s legitimacy directly on

the web page. For more information, you can follow us on Twitter

@societegenerale or visit our website www.societegenerale.com.

- Societe-Generale-SREP-notification-EN

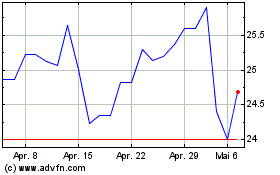

Societe Generale (BIT:1GLE)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

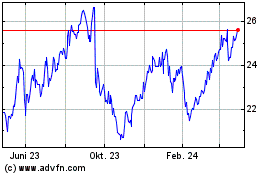

Societe Generale (BIT:1GLE)

Historical Stock Chart

Von Apr 2023 bis Apr 2024