Eni Simplifies Remuneration Policy, to Focus Production Strategy on Gas as Part of 2023-26 Plan -- Update

23 Februar 2023 - 3:10PM

Dow Jones News

By Giulia Petroni

Eni SpA has simplified and boosted its shareholder remuneration

policy and said it aims to increase the share of gas in its

production mix as part of its strategic plan for 2023-26.

At its capital markets day on Thursday, the Italian oil-and-gas

major said it plans to distribute between 25%-30% of annual cash

flow from operations through a combination of dividend and share

buyback. Eni's policy was previously linked to oil-and-gas prices

rather than to CFFO.

The company has set its annual dividend at EUR0.94 per share for

2023, which represents a 7% increase on year, and said it will

launch a 2.2 billion euros ($2.33 billion) share buyback following

shareholder approval in May.

Eni expects production to grow at an average of 3%-4% over

2023-26 and plateau to 2030, and said it will progressively

increase the share of gas in the portfolio to 60% by the end of the

decade. The upstream segment's capex will be between EUR6

billion-EUR6.5 billion on average per year during the plan

period.

Chief Executive Claudio Descalzi said that oil will decline in

the company's mix while gas will continue to rise. Eni expects to

grow contracted liquefied natural gas to over 18 million tons per

year by 2026 from 9 mtpa in 2022 and confirmed it will replace

Russian gas volumes by 2025.

"We have been focusing our exploration and production strategy

mainly on gas, leveraging our own production and diversifying our

investments across different countries," Mr. Descalzi said. "This

has enabled us to put in place our plan aimed at replacing 20

billion cubic meters of Russian gas by 2025."

Eni has also outlined its financial objectives, saying it

targets earnings before interest and taxes of EUR13 billion in

2023. CFFO before working capital is seen at over EUR17 billion in

2023 and over EUR69 billion over the plan period. The company said

this will allow it to organically fund investment and enhance

shareholder distributions while maintaining leverage in a 10%-20%

range.

Capital expenditure is seen at around EUR9.5 billion in 2023 and

EUR37 billion over 2023-26, with around 25% of the total being

allocated toward low-and-zero carbon spending.

The company said it has also raised its biorefining capacity

target to over 3 mtpa by 2025 and over 5 mtpa by 2030, and sees its

renewables capacity growing to over 7 gigawatts by 2026 and over 15

GW by 2030.

Eni confirmed it expects to reduce its Scope 1, 2 and 3

emissions by 35% by 2030 and 80% by 2040 compared to 2018 levels,

and to reach net zero by 2050.

Write to Giulia Petroni at giulia.petroni@wsj.com

(END) Dow Jones Newswires

February 23, 2023 08:55 ET (13:55 GMT)

Copyright (c) 2023 Dow Jones & Company, Inc.

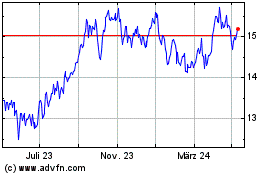

Eni (BIT:ENI)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

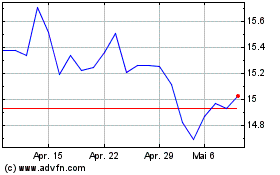

Eni (BIT:ENI)

Historical Stock Chart

Von Apr 2023 bis Apr 2024