Societe Generale: launch of ALD rights issue

NOT FOR PUBLICATION, RELEASE OR DISTRIBUTION,

DIRECTLY OR INDIRECTLY, IN WHOLE OR IN PART, IN OR INTO THE UNITED

STATES, CANADA, AUSTRALIA OR JAPAN, OR ANY OTHER JURISDICTION IN

WHICH IT WOULD BE UNLAWFUL TO DO SO

SOCIETE GENERALE:

LAUNCH

OF ALD

RIGHTS ISSUEPress release

Paris, November 29th 2022

Launch of ALD c.€1.2 billion capital

increase with shareholders’ preferential subscription rights in

connection with the contemplated acquisition of

LeasePlan

ALD, a subsidiary of Societe Generale, announced

today the launch of a capital increase with preferential

subscription rights for shareholders (the “Rights

Issue”) for an amount of approximately €1.2 billion.

The principle of this Rights Issue was initially

announced on January 6th, 2022 in connection with the announcement

of ALD’s plan to acquire LeasePlan and marks a major milestone in

the creation of a leading global sustainable mobility player,

benefiting from highly complementary expertise and synergies.

Societe Generale, which currently holds 79.8% of

ALD’s share capital, is committed to remaining a long-term majority

shareholder of ALD with a targeted ownership corresponding to c.

53% of the new group’s share capital upon closing of the LeasePlan

acquisition1. In this regard, Societe Generale will participate in

the Rights Issue for a total subscription amount of approximately

€803 million. Moreover, Societe Generale has undertaken to fully

underwrite the capital increase and has also committed not to sell

its shares for a period ending 40 months after the completion of

the LeasePlan acquisition and to a lock-up starting on the date of

signing of the placement agency agreement relating to the Rights

Issue and ending 180 calendar days following the

settlement-delivery of the Rights Issue (subject to certain

exceptions).

The impact of this acquisition on the Societe

Generale Group's CET1 capital ratio is expected to be around 40

basis points at the closing date of the transaction. Societe

Generale would benefit from a ROTE uplift between 70 and 80 basis

points in 20242.

For more information on the terms and conditions

of the capital increase, please consult the capital increase

dedicated section on ALD’s institutional

website:(https://www.aldautomotive.com/investors/acquisition-of-leaseplan/rights-issue).

Press contact:

Jean-Baptiste Froville_+33 1 58 98 68 00_

jean-baptiste.froville@socgen.comFanny Rouby_+33 1 57 29 11 12_

fanny.rouby@socgen.com

Societe

Generale

Societe Generale is one of the leading European

financial services groups. Based on a diversified and integrated

banking model, the Group combines financial strength and proven

expertise in innovation with a strategy of sustainable growth.

Committed to the positive transformations of the world’s societies

and economies, Societe Generale and its teams seek to build, day

after day, together with its clients, a better and sustainable

future through responsible and innovative financial

solutions.Active in the real economy for over 150 years, with a

solid position in Europe and connected to the rest of the world,

Societe Generale has over 117,000 members of staff in 66 countries

and supports on a daily basis 25 million individual clients,

businesses and institutional investors around the world by offering

a wide range of advisory services and tailored financial solutions.

The Group is built on three complementary core businesses:

- French

Retail Banking which encompasses the Societe Generale,

Credit du Nord and Boursorama brands. Each offers a full range of

financial services with omnichannel products at the cutting edge of

digital innovation;

-

International Retail Banking, Insurance and Financial

Services, with networks in Africa, Central and Eastern

Europe and specialised businesses that are leaders in their

markets;

- Global Banking and Investor

Solutions, which offers recognised expertise, key

international locations and integrated solutions.

Societe Generale is included in the principal

socially responsible investment indices: DJSI (Europe), FTSE4Good

(Global and Europe), Bloomberg Gender-Equality Index, Refinitiv

Diversity and Inclusion Index, Euronext Vigeo (Europe and

Eurozone), STOXX Global ESG Leaders indexes, and the MSCI Low

Carbon Leaders Index (World and Europe). In case of doubt regarding

the authenticity of this press release, please go to the end of

Societe Generale’s newsroom page where official Press Releases sent

by Societe Generale can be certified using blockchain technology. A

link will allow you to check the document’s legitimacy directly on

the web page. For more information, you can follow us on Twitter

@societegenerale or visit our website www.societegenerale.com.

Disclaimer

This press release does not constitute an offer

to sell nor a solicitation of an offer to buy, nor shall there be

any sale of ordinary shares in any state or jurisdiction in which

such an offer, solicitation or sale would be unlawful prior to

registration or qualification under the securities laws of any such

state or jurisdiction.

The distribution of this document may, in

certain jurisdictions, be restricted by local legislations. Persons

into whose possession this document comes are required to inform

themselves about and to observe any such potential local

restrictions.

This press release is an advertisement and not a

prospectus within the meaning of Regulation (EU) 2017/1129 of the

European Parliament and of the Council of 14 June 2017 (as amended,

the “Prospectus Regulation”). Potential investors are advised to

read the prospectus before making an investment decision in order

to fully understand the potential risks and rewards associated with

the decision to invest in the securities. The approval of the

prospectus by the AMF should not be understood as an endorsement of

the securities offered or admitted to trading on a regulated

market.

With respect to the Member States of the

European Economic Area (other than France) and the United Kingdom

(each a “Relevant State”), no action has been undertaken or will be

undertaken to make an offer to the public of the securities

referred to herein requiring a publication of a prospectus in any

Relevant State. As a result, the securities may and will be offered

in any Relevant State only (i) to qualified investors within the

meaning of the Prospectus Regulation, for any investor in a Member

State of the European Economic Area, or Regulation (EU) 2017/1129

as part of national law under the European Union (Withdrawal) Act

2018 (the “UK Prospectus Regulation”), for any investor in the

United Kingdom, (ii) to fewer than 150 individuals or legal

entities (other than qualified investors as defined in the

Prospectus Regulation or the UK Prospectus Regulation, as the case

may be), or (iii) in accordance with the exemptions set forth in

Article 1 (4) of the Prospectus Regulation or under any other

circumstances which do not require the publication by ALD of a

prospectus pursuant to Article 3 of the Prospectus Regulation

and/or to applicable regulations of that Relevant State.

The distribution of this press release has not

been made, and has not been approved, by an “authorised person”

within the meaning of Article 21(1) of the Financial Services and

Markets Act 2000. As a consequence, this press release is only

being distributed to, and is only directed at, persons in the

United Kingdom that (i) are “investment professionals” falling

within Article 19(5) of the Financial Services and Markets Act 2000

(Financial Promotion) Order 2005 (as amended, the “Order”), (ii)

are persons falling within Article 49(2)(a) to (d) (“high net worth

companies, unincorporated associations, etc.”) of the Order, or

(iii) are persons to whom an invitation or inducement to engage in

investment activity (within the meaning of Article 21 of the

Financial Services and Markets Act 2000) in connection with the

issue or sale of any securities may otherwise lawfully be

communicated or caused to be communicated (all such persons

together being referred to as “Relevant Persons”). Any investment

or investment activity to which this document relates is available

only to Relevant Persons and will be engaged in only with Relevant

Persons. Any person who is not a Relevant Person should not act or

rely on this document or any of its contents.

This press release may not be published,

distributed or transmitted in the United States of America

(including its territories and dependencies). This press release

does not constitute or form part of any offer of securities for

sale or any solicitation to purchase or to subscribe for securities

or any solicitation of sale of securities in the United States of

America. The securities referred to herein have not been and will

not be registered under the U.S. Securities Act of 1933, as amended

(the “Securities Act”) or the law of any State or other

jurisdiction of the United States of America, and may not be

offered or sold in the United States of America absent registration

under the Securities Act or pursuant to an exemption from, or in a

transaction not subject to, the registration requirements of the

Securities Act. ALD does not intend to register all or any portion

of the securities in the United States of America under the

Securities Act or to conduct a public offering of the securities in

the United States of America.

This announcement may not be published,

forwarded or distributed, directly or indirectly, in the United

States of America, Canada, Australia, South Africa, or Japan.

1 Assuming the full exercise of the warrants

granted to Leaseplan’s shareholders, c. 51% of the new group’s

share capital upon closing of the LeasePlan acquisition2 Computed

based on 2024 net income group share post AT1 cost consensus

estimate (Factset end 2021), including fully phased run rate

synergies and excluding restructuring costs, divided by average

tangible shareholders’ equity

- Societe-Generale-Launch-Righ-Issue-ALD

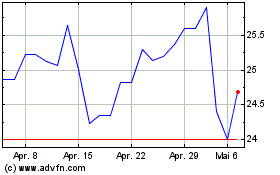

Societe Generale (BIT:1GLE)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

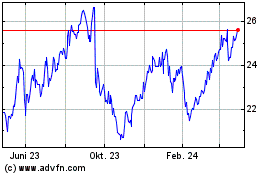

Societe Generale (BIT:1GLE)

Historical Stock Chart

Von Apr 2023 bis Apr 2024