MMR's Equinox Bid A Test Case For Australia's Investment Regime

04 April 2011 - 9:41AM

Dow Jones News

The C$6.3 billion takeover offer by Minmetals Resources Ltd.

(1208.HK), or MMR, for Equinox Minerals Ltd. (EQN.AU) could prove a

test case for the approach of Australia's foreign investment

regulator, according to lawyers familiar with the process.

The bid for Equinox--which is domiciled in Canada--dual-listed

on the Sydney and Toronto stock exchanges, and focused on projects

in Zambia and Saudi Arabia--should give more clarity on how broadly

the country's Foreign Investment Review Board extends its oversight

into overseas assets.

"This will be an interesting test case," said Simon Morris, a

partner at Corrs Chambers Westgarth in Melbourne, who worked on

Yanzhou Coal Mining Co. Ltd.'s (YZC) A$3.54 billion takeover of

coal miner Felix Resources Ltd. The Felix acquisition is China's

largest takeover of an Australian company to date.

"My gut feel is that it will be hard for FIRB to have a major

view against this. It would certainly be a touch provocative if

they did," Morris said.

The regulator has attracted overseas attention in recent years

for standing in the way of several takeovers in the resources

sector, especially where state-owned companies are seen as taking

control of Australian assets. That's significant because Hong

Kong-listed MMR is 75% owned by China Minmetals Corp., a

state-owned company.

The regulator blocked MMR's predecessor MMG Ltd. from taking

control of the Prominent Hill mine in 2009 when it attempted to

take over debt-laden OZ Minerals Ltd. (OZL.AU) following its

creation from a merger of Oxiana Ltd. and Zinifex Ltd.

FIRB had objected to China Minmetals gaining control of the

mine, which is situated in the Woomera Prohibited Area, a

weapons-testing range in the outback of South Australia.

FIRB also objected to China Non-Ferrous Metal Mining (Group) Co.

Ltd. taking majority control of rare earths developer Lynas Corp.

Ltd. (LYC.AU), due to concerns about Beijing's control of the

global supply of the elements.

Most famously, an attempted US$19.5 billion investment in Rio

Tinto PLC (RIO) by Aluminum Corp. of China Ltd. (ACH), or Chinalco,

during the global financial crisis attracted bitter political

opposition in Australia.

Barnaby Joyce, an opposition senator, accused the government of

"selling Australia" in the deal, although Chinalco abandoned the

offer before FIRB had made a public decision.

FIRB is intended to preserve Australia's "national interest",

although the regulator doesn't define how it interprets that

phrase. Its recommendations are sent to the country's Treasurer,

who has the final say on investments.

The regulator has oversight of all major foreign investments in

the country--including deals such as Singapore Exchange Ltd.'s

ongoing A$7.3 billion offer for ASX Ltd. (ASX.AU)--but its

decisions on resources are particularly closely watched, given

Australia's position in the sector.

FIRB has said publicly that each investment is decided on a

case-by-case basis, but it prefers foreign investors to take a

stake of up to 15% in companies which have producing mines. It is

more flexible on projects not yet in production, signaling it will

approve deals for stakes of less than 50%.

Lawyers see the regulator as being less bothered about resource

companies where the assets are not in Australia, although such

deals technically fall within its jurisdiction.

"(Equinox) doesn't have the same sensitivities as a resource

play with Australian assets," said Malcolm Brennan, a special

counsel in Canberra for Mallesons. "But at the end of the day it's

an Australian company, listed on the Australian Securities

Exchange, and there remains a heightened sensitivity to foreign

government investment--even more so when it's a resources

proposal," he said.

MMR Chief Executive Andrew Michelmore told a media call Monday

that the company lodged its application to FIRB Mar. 11 and a

person familiar with the matter said the company did not anticipate

having any problems getting approval.

Brennan concurred with that view, adding that approval was

likely to take the standard 40-45 days, meaning it would likely be

granted by Apr. 22. Aiding the process would be the fact that MMR's

management worked closely with FIRB during the takeover of OZ

Minerals' assets, Brennan said.

There is some precedent for FIRB waving through so-called

'foreign-defined transactions', where both the target and acquirer

have their main operations outside Australia.

In January 2010 the regulator approved state-owned Zijin Mining

Group Co. Ltd.'s (601899.SH) A$545 million offer for Indophil

Resources N.L. (IRN.AU), a copper-gold miner focused on a project

in the Philippines. In addition, the regulator backed a May 2008

takeover offer for Herald Resources Ltd. by a joint venture of

state-owned Shenzhen Zhongjin Lingnan Nonfemet Co. Ltd. (000060.SZ)

and Indonesia's PT Antam Tbk.

John Mollard, a partner at Baker & McKenzie in Melbourne,

predicted the deal should get unconditional approval on that basis,

but warned the size of the transaction could mean it gets more

scrutiny than usual.

-By David Fickling, Dow Jones Newswires; +61 2 8272 4689; david.fickling@dowjones.com

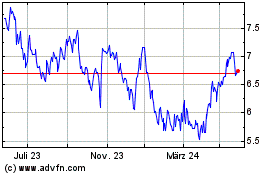

Lynas Rare Earths (ASX:LYC)

Historical Stock Chart

Von Okt 2024 bis Nov 2024

Lynas Rare Earths (ASX:LYC)

Historical Stock Chart

Von Nov 2023 bis Nov 2024