Australia Shares Midday: BHP, Telstra Up In Flat Market

31 März 2011 - 4:50AM

Dow Jones News

The Australian share market was flat Thursday with the market

leveling out after a strong two-week run.

"It's the end of the week after a very solid week," said Anthony

Anderson, senior trader at MF Global. "People are taking a little

bit of risk off the table heading into the weekend. BHP is really

the highlight of the market, that's really where all the strength

is."

BHP Billiton was up 2.0% to A$46.56. The overall S&P/ASX 200

was up 0.1% to 4827 as of 0213 GMT.

BHP Billiton shares were rallying while Woodside Petroleum's

stock was retreating. Woodside was down 2.4% to A$46.59. Woodside

said late Wednesday that it won't comment on rumors about a

potential takeover of the company's shares, adding that was

presumably the reason its shares were rallying this week.

Anderson said BHP's strength could be attributed to speculation

that a deal with Woodside is "perhaps not really as imminent as

people were thinking earlier in the week".

To compare, Rio Tinto was up 0.5%.

The other stand-out stock Thursday was Telstra, up 1.4%,

continuing its run after the Australian parliament agreed on

legislation setting out regulatory framework for the National

Broadband Network this week. Anderson also said a Dow Jones report

that Telstra is eyeing acquisitions in China's new media space was

boosting the stock.

Rare earths miner Lynas Corp. was up 5% to A$2.29 after the

group completed a A$55 million raising.

Traders weren't expecting much from the market for the rest of

the session.

"I think it will finish on the slightly positive side... without

any great fanfare," Jeremy Hook, private client adviser at TMS

Capital said.

The banks were lower, Commonwealth Bank lost 0.7%, Westpac was

down 0.3%, National Australia Bank shed 0.2% and ANZ retreated

0.7%.

Australian retail sales data rose a higher-than-expected 0.5% to

a seasonally adjusted A$20.53 billion in February, the Australian

Bureau of Statistics said Thursday. Economists surveyed ahead of

the announcement on average had expected a rise of 0.4%. Household

goods retailing rose 2.0%, while sales of clothing and footwear

rose 0.9% in February.

Retailers were mixed. Harvey Norman was up 0.7%; Myer Holdings

was up 0.3% and David Jones was down 0.2%. Conglomerate and

retailer Wesfarmers was down 2% while retail giant Woolworths was

down 0.1%.

-By Cynthia Koons; Dow Jones Newswires; +61-2-8272-4691; cynthia.koons@dowjones.com

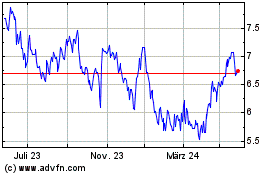

Lynas Rare Earths (ASX:LYC)

Historical Stock Chart

Von Okt 2024 bis Nov 2024

Lynas Rare Earths (ASX:LYC)

Historical Stock Chart

Von Nov 2023 bis Nov 2024